- 3,949

- 1,197

- Joined

- Nov 16, 2001

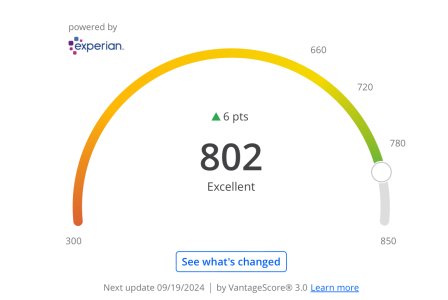

$100/mo. to do something you can do yourself "just in case"?Well I need some advice you guys. I'm looking in to possibly hiring Lexington law firm into repairing my credit. Their about 100 bucks a month and my cousin using them for a while and said they were great. My credit score is really low,and I'm looking to repair it in case for future needs ( house , car ,loan, etc). What would you guys do? If you guys would do something different,let me know different alternatives that way I can make a great decision.

If your credit is that bad, you have two options. If they are legitimate bad items that have already been paid off, close all of your accounts. Within about a year your score will be nonexistent and you can start over from scratch.

If you're behind on your bills, set up a repayment or settlement plan to get yourself on the right track again.

You're essentially asking, is it worth paying someone $1200 to do something for me that I can do myself so I can later pay someone else back their money with interest.

Unless you need a great credit score for security clearance don't take a shortcut. Do it yourself and learn from past mistakes.