Our 46th pushed this through kind of low key.

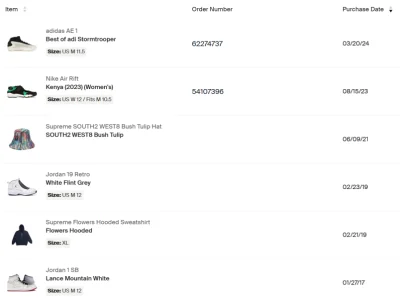

Tax question for some of you sellers,

Are you having to itemize or do a schedule C?

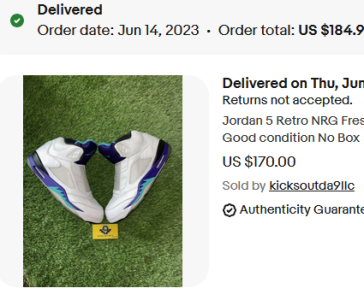

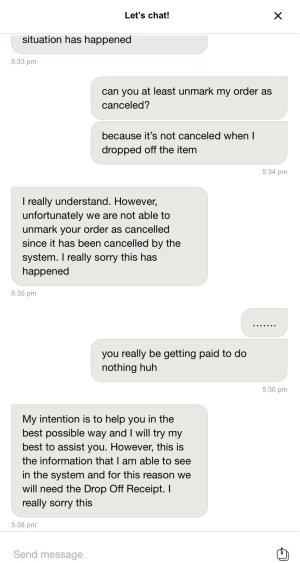

How can I prove $600 is not total profits?

Let’s say I get that 1099 with $600 in sales?

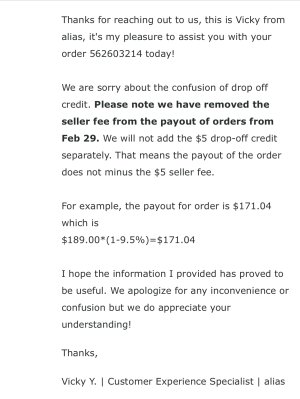

Maybe $200 of that came from the cost of the items. How hard is it to itemize and show proof?

Can you add in ink, boxes, and gas money for trips?

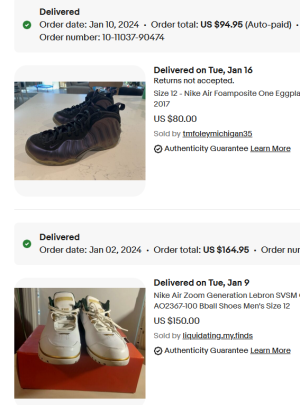

Does anyone who’s not a true LLC or reseller have a decent rundown if you just sell a bit on the side?

Add in 15% eBay fees, and now gross income increasing at 10-30%, and some people may not even make enough money to truly come out ahead. But the 1099 will make it look like a come up.

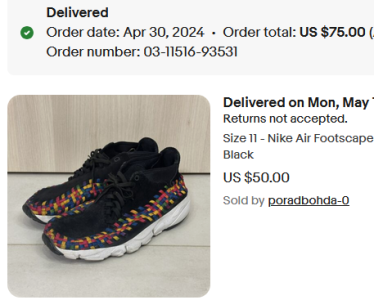

Are some of you just biting the bullet and laying the whole tax increase by increasing the price of your eBay items?

I just wonder if it’s worth the hassle.