If you want to slowly build up. Dollar cost average into them while buying lump sum on pullbacks like we saw this week - this is just my approach.What’s people’s tips or strategies to slowly building up in established stocks like Apple, etc? I want to put a steady stream, but the scope of it is a little intimidating.

Basically starting from scratch. It’s the first time in my adult life, that I’m at a steady income + got a good chunk saved already and am financially secure

Just looking for tips or strategies for me to consider.

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: this_feature_currently_requires_accessing_site_using_safari

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

OFFICIAL STOCK MARKET AND ECONOMY THREAD VOL. A NEW CHAPTER

- Thread in 'General' Thread starter Started by johnnyredstorm,

- Start date

- 11,363

- 30,041

- Joined

- Aug 24, 2017

cs02132

Supporter

- 13,034

- 13,418

- Joined

- Nov 1, 2007

I really need to get some $shop

I truly believe long term but I just got discouraged by the 3x price last year, wanted to get in around 400 just slacked on it

I truly believe long term but I just got discouraged by the 3x price last year, wanted to get in around 400 just slacked on it

- 5,561

- 3,850

- Joined

- Feb 18, 2007

I only trade SPACs so I don’t know much of what you guys are into. I keep seeing y’all bullish on $PINS and I’m not understanding why.

- 583

- 783

- Joined

- Sep 4, 2020

Would you mind posting your plays when you plan to make them? Not trying to trail necessarily, just have this huge blindspot re: SPAC plays in my approach. I want to focus my DD to save time as two kids and school is killing me right now.I only trade SPACs so I don’t know much of what you guys are into. I keep seeing y’all bullish on $PINS and I’m not understanding why.

- 5,561

- 3,850

- Joined

- Feb 18, 2007

Would you mind posting your plays when you plan to make them? Not trying to trail necessarily, just have this huge blindspot re: SPAC plays in my approach. I want to focus my DD to save time as two kids and school is killing me right now.

for SPACs unannounced top 2 would probably be IPOF and AJAX, if you want low risk high reward plays

SPACs unannounced but trading high already are CCIV and PSTH because of Lucid rumours (Tesla rival) and Bill Ackman factor

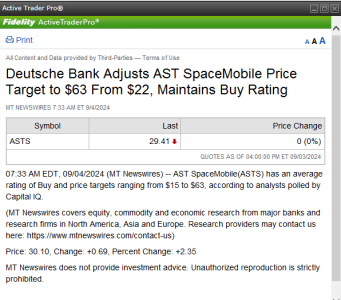

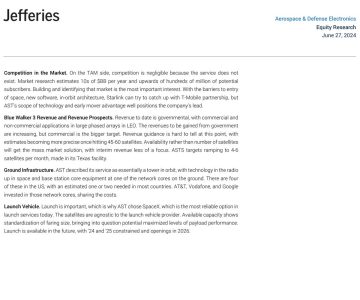

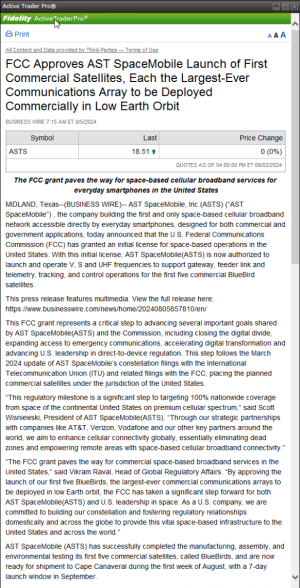

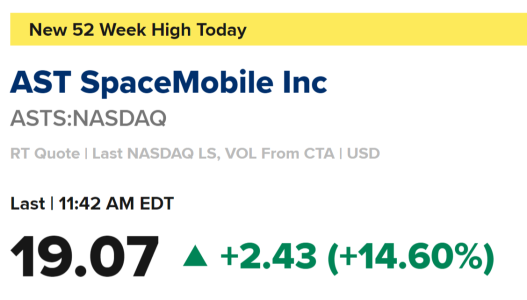

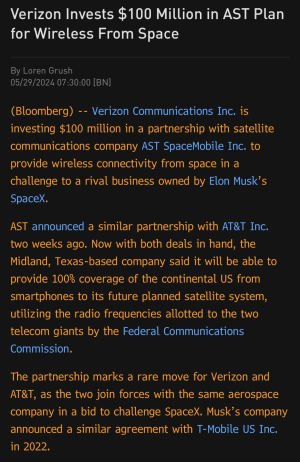

My super long term play would be $NPA, their satellites would provide mobile data globally for everyone and especially to rural areas and they’re backed by huge investors (Vodafone, Rakuten, Samsung, AT&T) #SpaceMobile

right now I’m in IPOE cause I think it’s undervalued af

Other SPACs you may be interested in SBE, ACTC, BFT, APXT, NGA, SRAC

Last edited:

- 1,838

- 1,699

- Joined

- Feb 12, 2015

$FUBO

that's all ima say. those who know how to do research will understand why once they see the numbers + what they have going on

that's all ima say. those who know how to do research will understand why once they see the numbers + what they have going on

- 74,750

- 24,147

- Joined

- Apr 4, 2008

Negative margins, cash burn issues, an eventual increase in S&M expenses to further grow their betting brand, 0 moat since they’re just a mVPOD who has ambitions to break into a highly competitive market like sports betting with 0 brand power to lure people away from established powerhouses like DKNG and Barstool, high revenue growth estimates, seems like a slam dunk bet.$FUBO

that's all ima say. those who know how to do research will understand why once they see the numbers + what they have going on

PINS is an advertising giant in the making that is completely agnostic to all of the issues FB faces from the people on its platform and is now entering the world of video ads, AR ads and offering classes through Zoom which will grow very quickly in the next year and help it become a powerhouse in of itself. There’s so much more to dive into so if you want the dossiers just pm me. This is a stock growing well in America and rapidly ROW and it reminds me of FB 7 years ago. $100 billion MC is my short term target. It should be at the worst parity to SNAP.

never price anchor. Don’t be upset you missed shop at 400 and wait for it to get there. If buying st 1200 doesn’t make sense for your plan that’s different but if y out want to own it just DCA over time. Apple don’t even think about it. Just buy two shares a week or whatever your scaling strategy is and never look back.

I go into my hedging process a little on this week’s podcast episode but basically I look at where I think a stock can go after it breaks a downside pivot and I buy a $5 put spread for .60 or less targeting that area and I do this ideally to try and make back some of the money Id lose but most of the time I lose the hedge completely so be aware. It’s 100% money I’m ok losing and money that I’d make 3-5x minimum more on if the stock rips higher. So if I have a tiny position in a stock, I won’t hedge, I’ll just sell it outright if I don’t care about it or if I’m building it I’ll just wait for lower prices to scale in.

that AJAX team is fire. I’ve been looking at them but I’m solid for now with just HAACU for spac’s with no merger. Someone brought FCAC to my attention but I haven’t researched it yet. ShareCare is the rumor.

- 4,391

- 4,604

- Joined

- Jul 20, 2012

Yooooooooo

instagram.com

instagram.com

Login • Instagram

Welcome back to Instagram. Sign in to check out what your friends, family & interests have been capturing & sharing around the world.

instagram.com

instagram.com

- 1,838

- 1,699

- Joined

- Feb 12, 2015

I copped $17K worth at $46, i didn't even care to wait for it to go down. I won't even look at it for years to come, just gonna park my money in there with no worries as I know for sure it will keep growing.Negative margins, cash burn issues, an eventual increase in S&M expenses to further grow their betting brand, 0 moat since they’re just a mVPOD who has ambitions to break into a highly competitive market like sports betting with 0 brand power to lure people away from established powerhouses like DKNG and Barstool, high revenue growth estimates, seems like a slam dunk bet.

PINS is an advertising giant in the making that is completely agnostic to all of the issues FB faces from the people on its platform and is now entering the world of video ads, AR ads and offering classes through Zoom which will grow very quickly in the next year and help it become a powerhouse in of itself. There’s so much more to dive into so if you want the dossiers just pm me. This is a stock growing well in America and rapidly ROW and it reminds me of FB 7 years ago. $100 billion MC is my short term target. It should be at the worst parity to SNAP.

never price anchor. Don’t be upset you missed shop at 400 and wait for it to get there. If buying st 1200 doesn’t make sense for your plan that’s different but if y out want to own it just DCA over time. Apple don’t even think about it. Just buy two shares a week or whatever your scaling strategy is and never look back.

I go into my hedging process a little on this week’s podcast episode but basically I look at where I think a stock can go after it breaks a downside pivot and I buy a $5 put spread for .60 or less targeting that area and I do this ideally to try and make back some of the money Id lose but most of the time I lose the hedge completely so be aware. It’s 100% money I’m ok losing and money that I’d make 3-5x minimum more on if the stock rips higher. So if I have a tiny position in a stock, I won’t hedge, I’ll just sell it outright if I don’t care about it or if I’m building it I’ll just wait for lower prices to scale in.

that AJAX team is fire. I’ve been looking at them but I’m solid for now with just HAACU for spac’s with no merger. Someone brought FCAC to my attention but I haven’t researched it yet. ShareCare is the rumor.

- 12,298

- 9,321

- Joined

- Oct 28, 2006

- 27,383

- 27,172

- Joined

- Aug 5, 2012

Def trying to get out of RH, can't take it anymore lol

For those using WeBull how do you like it?

For those using WeBull how do you like it?

- 10,172

- 26,391

- Joined

- May 3, 2009

- 21,509

- 12,298

- Joined

- Oct 10, 2005

Look how smug this dude is.

**** the Mets

Just like the Mets, he folded under pressure

.

.- 9,530

- 15,515

- Joined

- Jul 30, 2017

Breakingviews - Breakingviews - Daimler could be Elon Musk's Time Warner

Electric-car maker Tesla is worth an eye-popping $540 billion despite a puny 0.8% global market share. It's an opportunity for boss Elon Musk to use the company's hyped-up stock to merge with an old-line business, just as AOL did with media titan Time Warner 20 years ago amid the dot-com bubble...

kilroythedon

Supporter

- 23,160

- 21,978

- Joined

- Feb 20, 2013

One day the universe will correct itself and douchebags won’t own sport franchises people actually love..

- 74,750

- 24,147

- Joined

- Apr 4, 2008

The acquisition sounds good, but referring to it as time Warner is a bad omen lol

Breakingviews - Breakingviews - Daimler could be Elon Musk's Time Warner

Electric-car maker Tesla is worth an eye-popping $540 billion despite a puny 0.8% global market share. It's an opportunity for boss Elon Musk to use the company's hyped-up stock to merge with an old-line business, just as AOL did with media titan Time Warner 20 years ago amid the dot-com bubble...reut.rs

so this my plan for next week. I’m still following the prices I put out there last week for adds but I’m down to just 1,900 bucks after deploying a lot of capital and reshuffling my portfolio. That money will be used for a SQ add lower than my cost (206) if we look heavy or possibly deployed elsewhere in the near future. If we have a correction in hedged for next week and feb 19. I’m not selling my core longs at all. I will continue hedging and buying out sorrads if needed if the market rolls over. The main thing I’m watching out for is the bounce after the dip. If we come out of it anemic and low volume, I’ll get defensive. If we print a lower high and look heavy to roll over, I’ll trim more and get aggressively short. But that’s only if we put in a lower high on big selling volume. My anticipation is a big rally off the dip if it comes but I’ll planning both ways in case. I also have hedges in March that are further down in price so we’ll see. Hopefully the hedges go to 0 but I wouldn’t mind the 30% correction because I’ll make a good chunk of change and I’m confident my stocks will make new highs by the end of the year. Don’t average down in losers. Own quality and hedge with money you WANT to lose completely.

- 21,509

- 12,298

- Joined

- Oct 10, 2005

The acquisition sounds good, but referring to it as time Warner is a bad omen lol

so this my plan for next week. I’m still following the prices I put out there last week for adds but I’m down to just 1,900 bucks after deploying a lot of capital and reshuffling my portfolio. That money will be used for a SQ add lower than my cost (206) if we look heavy or possibly deployed elsewhere in the near future. If we have a correction in hedged for next week and feb 19. I’m not selling my core longs at all. I will continue hedging and buying out sorrads if needed if the market rolls over. The main thing I’m watching out for is the bounce after the dip. If we come out of it anemic and low volume, I’ll get defensive. If we print a lower high and look heavy to roll over, I’ll trim more and get aggressively short. But that’s only if we put in a lower high on big selling volume. My anticipation is a big rally off the dip if it comes but I’ll planning both ways in case. I also have hedges in March that are further down in price so we’ll see. Hopefully the hedges go to 0 but I wouldn’t mind the 30% correction because I’ll make a good chunk of change and I’m confident my stocks will make new highs by the end of the year. Don’t average down in losers. Own quality and hedge with money you WANT to lose completely.

I watched your Podcast on YouTube. Good info on TDOC (LVGO), didn’t know they use AI to monitor people. Appreciate you downplaying how much time you actually spend on this “sneaker forum”

. Also, I would like to hear some Alien stories.

. Also, I would like to hear some Alien stories.- 74,750

- 24,147

- Joined

- Apr 4, 2008

Thanks

degenerate423

really appreciate you watching

degenerate423

really appreciate you watching

A anderson check out our twitter page @satoshialien episode 2 is being edited this weekend

So im looking at my twitter and noticed a dude who seems pretty chill and typically has good long biased perspective saying that he is going net short once he closes his GOGO position and now im thinking I may have missed something completely.

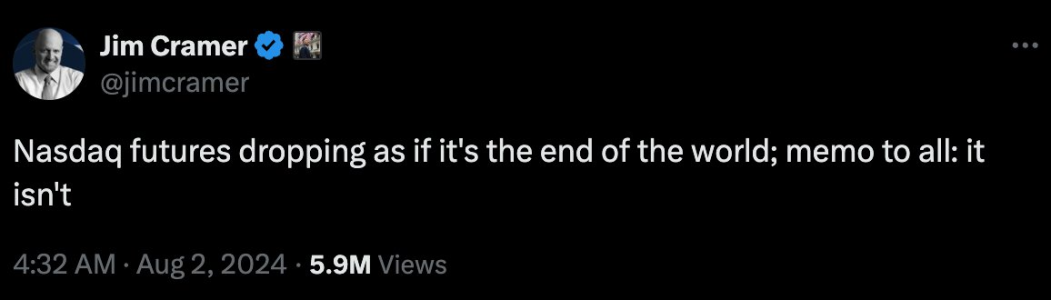

I think we may have been under distribution the entire month of December until now and they've been hiding the selling in this melt up. I'm not a pro at CANSLIM and the William O'Neil philosophy, but when I look this way at the chart without my roadmap on it, I missed something big time...I may be going conservative again this week and taking more short protection

A anderson check out our twitter page @satoshialien episode 2 is being edited this weekend

So im looking at my twitter and noticed a dude who seems pretty chill and typically has good long biased perspective saying that he is going net short once he closes his GOGO position and now im thinking I may have missed something completely.

I think we may have been under distribution the entire month of December until now and they've been hiding the selling in this melt up. I'm not a pro at CANSLIM and the William O'Neil philosophy, but when I look this way at the chart without my roadmap on it, I missed something big time...I may be going conservative again this week and taking more short protection

- 583

- 783

- Joined

- Sep 4, 2020

Is it time to look at metals?

- 12,816

- 27,876

- Joined

- Aug 9, 2014

I watched

johnnyredstorm

’s YouTube pod, was curious to see what Niketalk’s own financial advisor looked like.... I mean random guy on the internet

johnnyredstorm

’s YouTube pod, was curious to see what Niketalk’s own financial advisor looked like.... I mean random guy on the internet

- 25,001

- 23,713

- Joined

- May 17, 2007

Is it time to look at metals?

There are certain metals and material I want to invest in but don’t really have any where to store it

- 28,824

- 17,432

- Joined

- Mar 22, 2003

HAPPY TO BE THE FIRST GUEST FOR 3% EQUITY

Similar threads

- Replies

- 22

- Views

- 2K

- Replies

- 1

- Views

- 1K