- 74,750

- 24,149

- Joined

- Apr 4, 2008

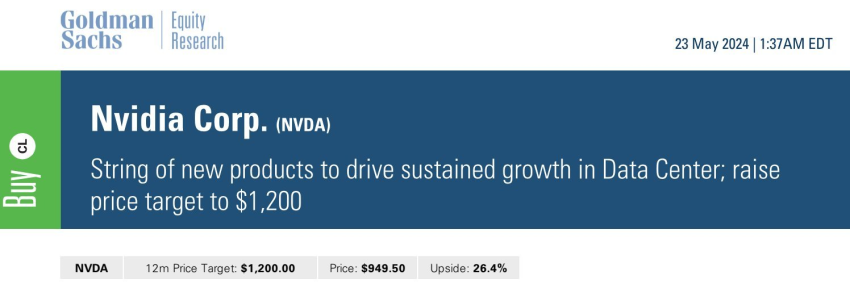

while we’re at it, I hope shop splits toosince we're talking splits, wouldn't mind an NVDA split either

What happens if AMC never gets back to the price you bought it at and only keeps going lower? What’s your plan? What’s your max pain? You should never enter a position without having answers to those questions before you click buy. Maybe AMC bounces again, but the reality is there is zero fundamental reason for it to. It’s a dying business with decreasing sales that’s in a sector seeing a shift to D2C that will shrink its margins and hurt its long term outlook. I don’t know what your average is or initial investment, but know what you own and where it can go. It doesn’t have to go up, just like it doesn’t necessarily have to go down either. But you should be prepared for the worst case scenario at all times and be comfortable with your decisions.What does it mean by Amazon splitting?

Yes, noob question.

I been trying to learn about stock trading for the past month and got distracted by these meme stocks. Once the AMC stock gets back to the price I bought it at I’m selling and getting back to YouTube University to get back to learning the fundamentals

I watched my dad baghold 1,000 shares of VJET from $55 all the way down to $1, through a reverse split, over the course of 8 years before the most ridiculous stock market of the millennium brought him to break even and not once was there ever a fundamental reason for the stock to go up. Be smart, manage risk, have a max pain and a plan.

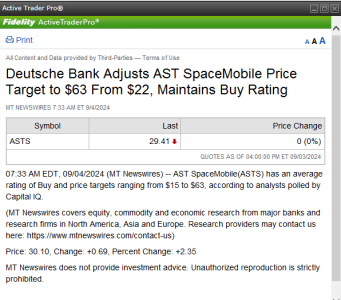

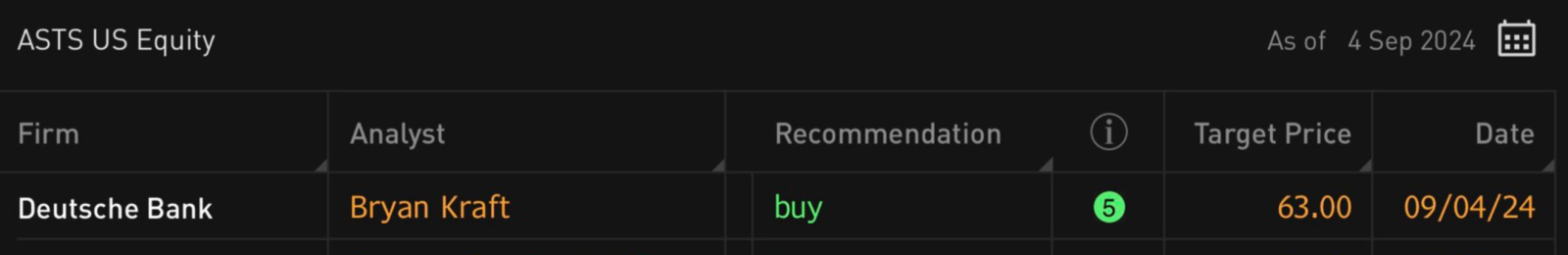

good thread on Amazon’s earnings. That ad growth

from Tikr.com

from Tikr.com