- 74,750

- 24,149

- Joined

- Apr 4, 2008

man I’ve had this issue a ton as well. I haven’t found a perfect way to address it, but aside from just scalping the breakout for a quick day trade, it might just have to be less size more range on the initial buy and wait for a confirmation of the breakout sticking (so a trend forming on the 1 minute after 10 am). I’ve also been buying the retest after the breakout and I think that could work as well. The best plays for me have come when I’m already in the stock during the base building period and I add with some house money on the breakout or buy more on the retest. I’ll only trade stocks these days that I’m comfortable buying and holding for a year if I decided to, just relieves some pressure, I don’t do well with buying garbage tbh.Can u talk about confirming a breakout? Seems a common issue for me is going in on a breakout only to have it reverse. Or even worse it reverses, take out my stop below the breakout, and then continues higher. Find myself missing a majority of the move waiting, or just death by a thousand cuts taking a bunch of stop losses.

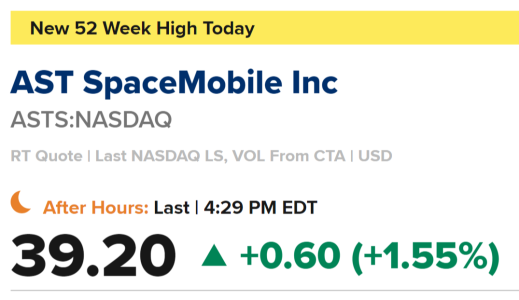

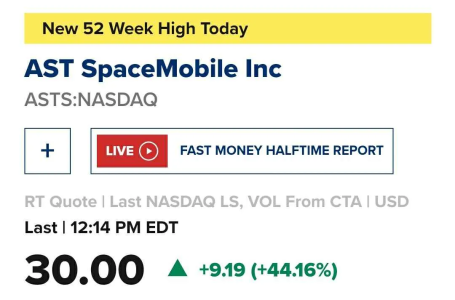

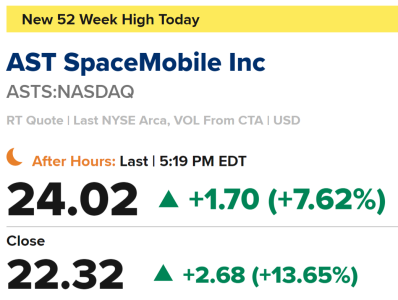

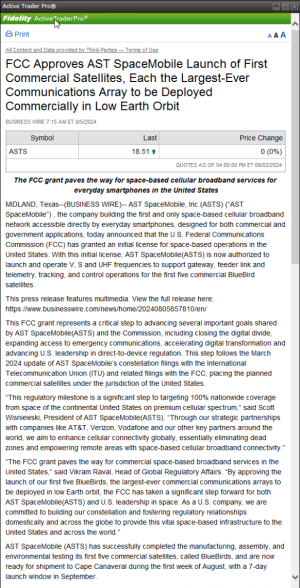

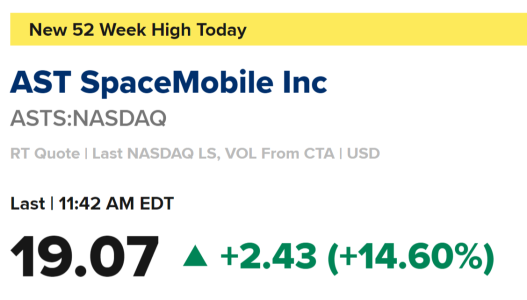

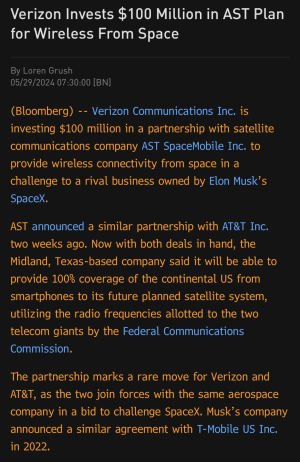

Included the first buy signal, then we saw that repeated on the ATH breakout, now we just had a shakeout/retest and want I want to see is a move through today’s high to confirm, or if an inside day, we hold today’s lowI’m interested if the offer stands. Whenever you have time bro. Roku or Apple, whichever illustrates the point better. Or anyone really.

ROKU im anticipating this one to play out like the previous higher low that was made (first oval), again liking it through today’s highs as a trigger to anticipate a breakout to new ATH’s. Doesn’t mean it’ll work but recognizing a pattern and managing risk from it is the best you can do

I will say trips to the 21 ema during a bull market offer good r/r typically if you see it hold with some wicks that go beneath it and get snatched up back above it. It might chop around on it for a few days so be aware.

I didn’t realize I was paying the past couple years

I didn’t realize I was paying the past couple years