- 74,750

- 24,147

- Joined

- Apr 4, 2008

Too many easy set ups that looked awesome. Market would never make it easy for us  tried a day trade in PINS that I stopped basically for a $7 loss after adding in initially.

tried a day trade in PINS that I stopped basically for a $7 loss after adding in initially.

HAACU is printing today tho 13.45

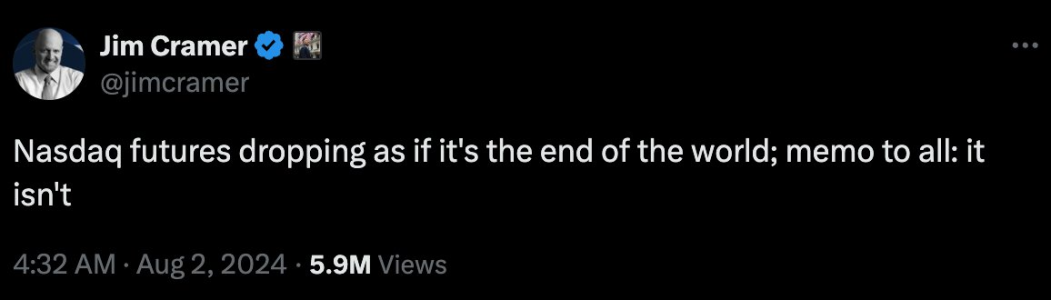

Look at your watchlist, see what's green and holding up while SPY and QQQ are selling, those are your leaders.

Bot 1 share of FB today for my daughter's account, and $200 worth of GOOGL, waiting for a redemption fee to go away to sell one of her mutual funds to buy more Google. I had too many aggressive growth funds that basically all held the same stocks so I'm looking to consolidate and create that moderate risk portfolio for her that captures some of the thematics of the next decade in addition to her funds.

tried a day trade in PINS that I stopped basically for a $7 loss after adding in initially.

tried a day trade in PINS that I stopped basically for a $7 loss after adding in initially. HAACU is printing today tho 13.45

Look at your watchlist, see what's green and holding up while SPY and QQQ are selling, those are your leaders.

Bot 1 share of FB today for my daughter's account, and $200 worth of GOOGL, waiting for a redemption fee to go away to sell one of her mutual funds to buy more Google. I had too many aggressive growth funds that basically all held the same stocks so I'm looking to consolidate and create that moderate risk portfolio for her that captures some of the thematics of the next decade in addition to her funds.

. Been a huge help in answering my dumb questions haha. Happy to be here though, exciting times to jump in!

. Been a huge help in answering my dumb questions haha. Happy to be here though, exciting times to jump in!