snkrfollower

Supporter

- 11,224

- 24,177

- Joined

- Apr 2, 2014

Don't give them your social security number

I checked with them and they said the official rules stated the Approx. Retail Value of the hoodie at $950 based on current market prices, which I'm honestly not sure you can base a "retail" price on. Here's the rules: https://s3.amazonaws.com/stockx-sne...Supreme-Box-Logo-Hoodie-ReStockX-Rules_F2.pdf

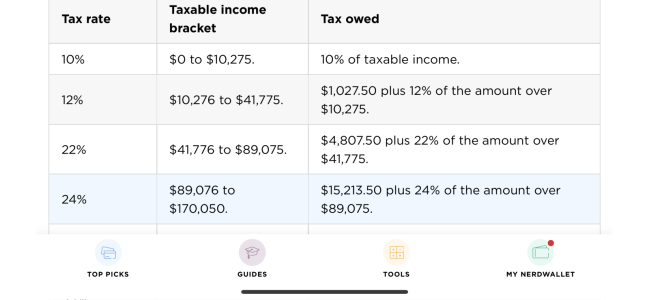

Section 6 has the ARV and mentions they'll send a 1099, but I'm pretty sure the 1099 is based on actual profit/loss realized, not theoretical value. Just like if you buy stock at $X, and stock value rises to 3X, you don't owe taxes until you actually sell and receive the $$$ profit from the stock.

Here's what I was told specifically:

"You paid the original retail price for the hoodie of $168. Per the contest rules, we listed the approximate retail value for it at $950. The difference between those two numbers is $782 and because that additional value is greater than $600, we need to record this via a 1099 as income that you've received from StockX and make sure it's taxed appropriately."

Honestly, I'm more than cool paying tax I owe if/when I flip it for $1300+, but this doesn't sound like it's how things are supposed to be done, especially since I actually paid the original retail price for the item. I did tell him that if I do send the W9 back, I'm sending a hard copy, nothing digital. I can only imagine them being hacked one day and somebody getting like ALL of my info.