- 490

- 443

- Joined

- Jan 19, 2006

Nice reminder for any low to mid income people. The retirement saving credit is highly underutilized. It's like the one mentioned above but at a lower threshold.

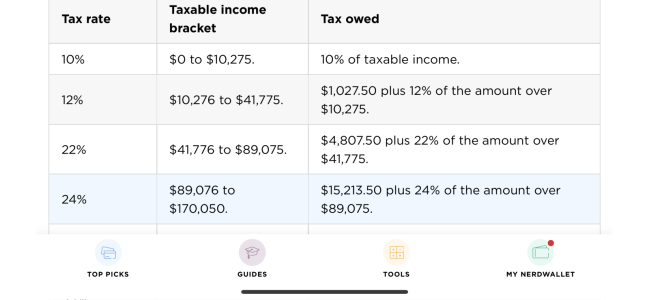

Basically a percentage of what you save can be credited back and knock off any tax liability you may have. The saved amount also knocks down your AGI. An average single person earning $30k can save $400 on top of their saving of $2,000. Whatever you would have withheld can now go to your savings. Your $2000 saved already saw an immediate 20% return.

Another example. An average dude making $19k has an average tax liability of around $600. If you save $1000, half of that negates your liability. You have $1000 put away and now owe maybe $100 bucks at the end of the year. But now your AGI goes down and your liability is a mere $500. You Could almost get away with withhding nothing and using that extra weekly income into your savings. Not exactly free money but these little quirks can be helpful. Tl;Dr. Save $1000 to get $500 in credits

Explain is there is a 401k credit ?