- 3,667

- 2,457

- Joined

- Feb 29, 2008

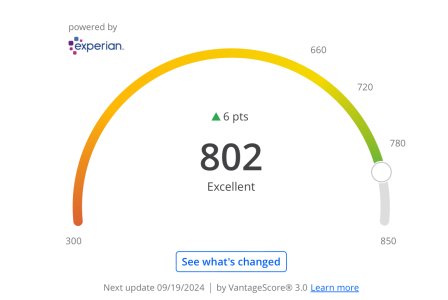

Lol I feel that. I'm still a ways from 800 my highest is 750.

With utilization does it count per card or all of them combined? Say i have a card for $1k and max it out and my other card is $5k with full availability, would i still count as under 30%?

It's kinda both. Maxing out a card is never good and will make your scores drop a good bit even if you have your total utilization under 30%.

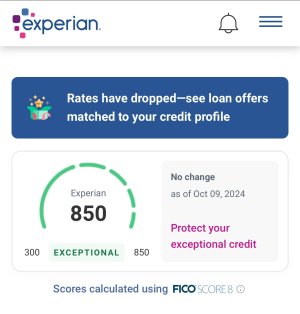

.. Like you said I'm trying to get into that 800 club

.. Like you said I'm trying to get into that 800 club  .. guess I'll catch up with this thread to see what little things I can do to increase my score, I'm not that far off from 800.

.. guess I'll catch up with this thread to see what little things I can do to increase my score, I'm not that far off from 800.

lol

lol