- 19,749

- 25,936

- Joined

- May 27, 2017

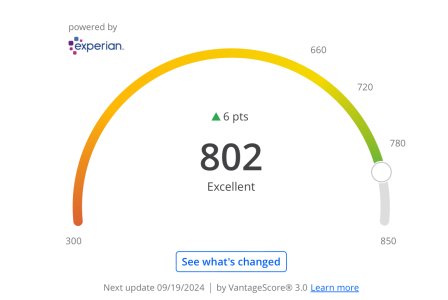

How long should I wait to close it then? The limit is 2000. It shouldn't affect my utilization rate since I have CCs with higher limitsMistake.

Your CScore will certainly take a hit closing that card after 6 months. I vehemently encourage my clients to NEVER open store cards. If you wanted 0% APR, there's a slew of CCs that offer 12+ months of zero percent interest plus cash back bonuses. Store cards offer low credit limits, little incentives and high interest rates. Avoid them at all costs.

/rant

I have several CCs I don't use and I'm trying to declutter