- 2,631

- 218

- Joined

- Mar 31, 2006

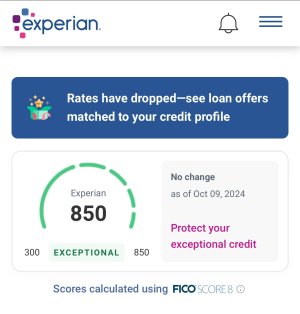

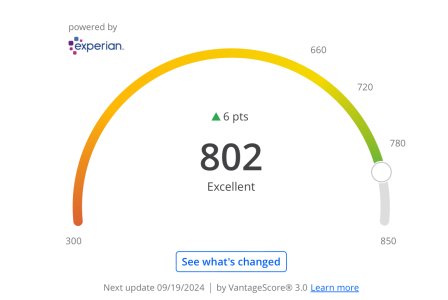

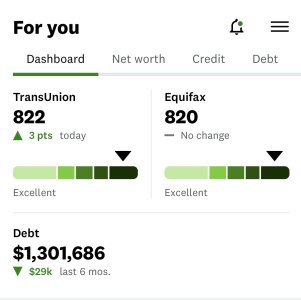

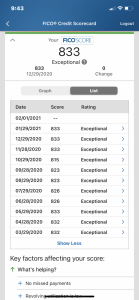

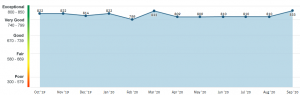

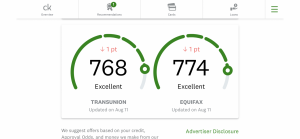

I have around 10+ hard inquires in the last two years. When I applied for the chase freedom card, my experian fico score went up 3 points.

I think inquires account for 10% of your score.

I think inquires account for 10% of your score.

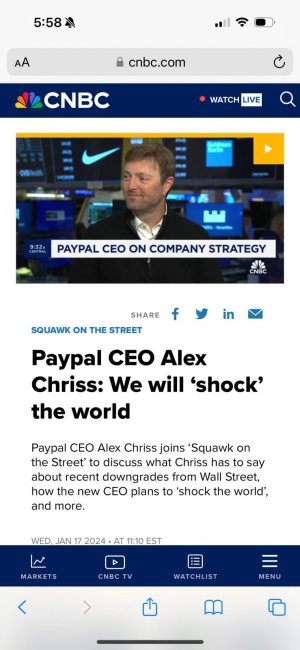

at that Black Card.

at that Black Card.