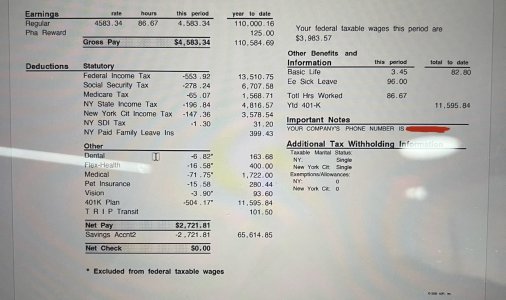

- 4,758

- 1,409

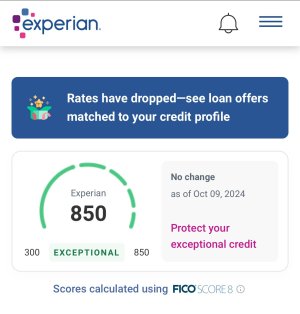

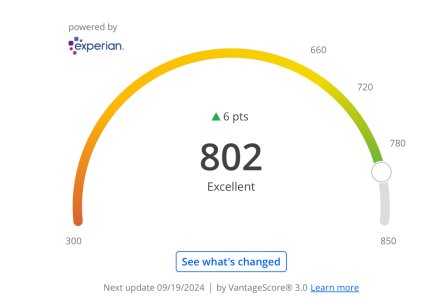

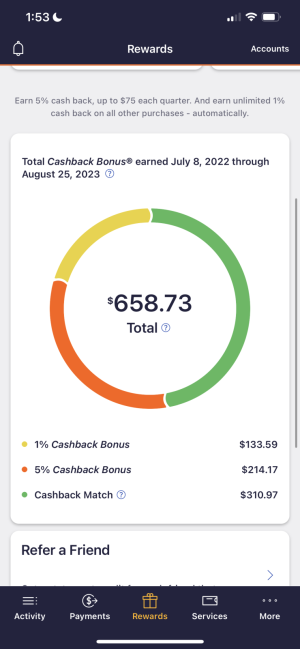

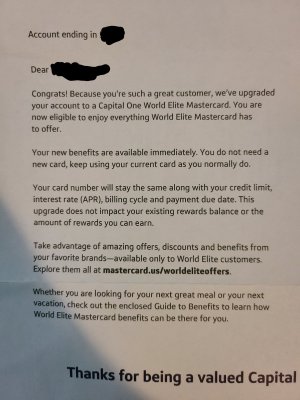

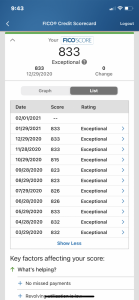

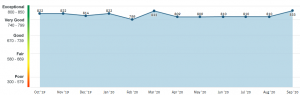

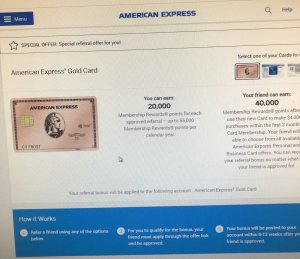

No, if you are just using it to build credit then get a $250 secured card. Don't leave more than a $22.5 dollar balance, thats 9% and for best scores only keep a balance between 1%-9%. That low balance is why I was saying get a $500 card, $45 would be the max balance you want to report when the statement cuts.Nah man I got the money to get what I want but I wanna start to build my credit

I've managed to save some stacks over the last year. So when I would get te card what would be te best way? Do I max it out and pay it in full next month? Or do lil 40 here and there and pay it in full or pay it off lil by lil?

Also don't let $0 cut on the statement unless you have other cards.

Last edited:

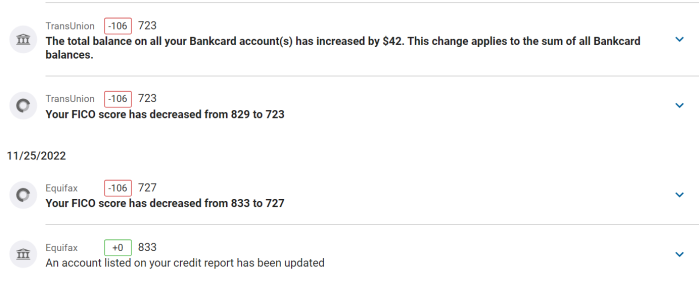

. I cant find the receipt of the date so they don't want to have it removed

. I cant find the receipt of the date so they don't want to have it removed