Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Home Buying & Real Estate Thread

- Thread in 'General' Thread starter Started by TYE_The Time Traveler,

- Start date

- Nov 26, 2012

- 7,165

- 1,812

Last edited:

- Jul 27, 2012

- 1,563

- 1,828

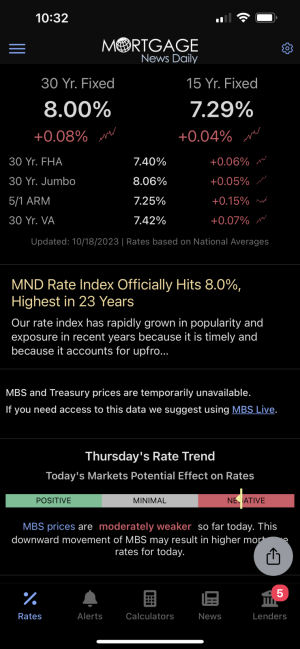

4.625 and have 27 years left

I would look into it especially with the interest rates being in the 3's. Maybe look into a 20

Yr. I think you'll be able to save money

- Jan 19, 2002

- 23,520

- 5,672

Risk it and wait for rates to drop more or do it now at 3.375 for 20 years?4.625 and have 27 years left

I would look into it especially with the interest rates being in the 3's. Maybe look into a 20

Yr. I think you'll be able to save money

- Mar 31, 2006

- 2,631

- 218

Does

This is something I'm definitely worried about. There are about 15-20 homes where we're looking that are the same models and were built in 2004. One sold for 554K in Jan 2014. Another sold in Jan 2016 for for $730k. Those were semi attached. An attached unit just went into contract for $760k. There's a semi attached for sale but they're asking 780K. We saw it on Thursday and really like it. We were only able to see the owners unit because the tenant wasn't home but the lay out is the same. My realtor told me we should try to get it before the other home closes. He advised us to go in at 750K. The owners need to move soon to get their kids enrolled in school in time so thats a plus.

I look at appreciation as a bonus but I wanna go into a home thinking we can't lose money. I know NYC is a great market but it definitely has me wondering if we're buying at a bad time.

It's hard to say. I've been straddling both sides of the argument for the past couple years. I see the debt burden of average Americans skyrocketing again combined with the LONG (historically) bull market going on and think we're overdue for some sort of recession soon. Credit card debt, student loan debt, and auto debt have each surpassed the $1T point while the about 50% of people can't pay for a $500 emergency out of pocket.

If I weren't already a homeowner and couldn't afford a home at this point, I would start socking the money away to take advantage of an unfortunate situation.

This is something I'm definitely worried about. There are about 15-20 homes where we're looking that are the same models and were built in 2004. One sold for 554K in Jan 2014. Another sold in Jan 2016 for for $730k. Those were semi attached. An attached unit just went into contract for $760k. There's a semi attached for sale but they're asking 780K. We saw it on Thursday and really like it. We were only able to see the owners unit because the tenant wasn't home but the lay out is the same. My realtor told me we should try to get it before the other home closes. He advised us to go in at 750K. The owners need to move soon to get their kids enrolled in school in time so thats a plus.

I look at appreciation as a bonus but I wanna go into a home thinking we can't lose money. I know NYC is a great market but it definitely has me wondering if we're buying at a bad time.

al audi

Banned

- Jun 18, 2009

- 29,810

- 4,562

It's hard to say. I've been straddling both sides of the argument for the past couple years. I see the debt burden of average Americans skyrocketing again combined with the LONG (historically) bull market going on and think we're overdue for some sort of recession soon. Credit card debt, student loan debt, and auto debt have each surpassed the $1T point while the about 50% of people can't pay for a $500 emergency out of pocket.

If I weren't already a homeowner and couldn't afford a home at this point, I would start socking the money away to take advantage of an unfortunate situation.

Right now we've had 7 years of economic growth and the average growth cycle is around 7 years followed by 11 months of recession. So we are at the peak of the market right now. I don't think we will see a market crash but a market correction is definitely in order.

We are in a rental bubble right now. Rental costs are astronomical. The number of renters spending more than 50% of income on housing is at a record high. The number of renters spending more than 30% of income on housing is also at a record high.

So if a market correction does happen, those of us that purchase investment properties need to plan accordingly. Don't want to buy at the top of the cycle and not be able to bring in the rents to cover minimum expenses.

Not saying it is imminent but that is where we are heading in my opinion.

mmmhmmmmm

i wont lie im not scared to get into rental property but it is worrisome...........i have no shame in saying i live at home currently either as a grown *** man, moms is good

i will be moving though of course just not where i planned to move before.........for example this time last year an area has gone up in 9% cost for renting........

the cost of rent is insane in my state but that goes for the tri state period

ive done some big adjusting and re-evalutating over the past few weeks personally

also, this might be a dumb question but does Presidential election effect housing market at all? is that too broad of a question?

Last edited:

- Nov 6, 2012

- 4,758

- 1,409

Al why don't you buy a multi family then rent out the other units. With a FHA loan you only have to put down 3.5% and can get up to a 4 unit property.

Live in 1 unit for a year then move.

Live in 1 unit for a year then move.

- Mar 31, 2006

- 2,631

- 218

We went to see a home today and we made an offer. The sellers agent is definitely not doing a good job. They had an open house today and she didn't advertise it until a few mins before it started. We passed by after we wrote up the offer and it was empty. It's been on the market for almost a month and the sellers are trying to move to FL by August.

The only thing is my banker went away for the weekend and my agent was trying to meet with the sellers tonight. :\

I still got a good feeling about this one!

The only thing is my banker went away for the weekend and my agent was trying to meet with the sellers tonight. :\

I still got a good feeling about this one!

- Nov 16, 2001

- 3,949

- 1,197

No. You'll pay the appraisal out of pocket, but a lot of lenders will reimburse you once the loan closes.You made a sacrificeDoesn't refinancing cost a lot of money ?From a time standpoint, no. Just do a break even analysis of what you would be saving vs. any out of pocket expenses. I have lived in my home for almost 2 years and have already done 2 refinances and am on the verge of pulling a 3rd after the rates dropped from the Brexit vote. I always do a slightly higher rate with a no cost refi since they typically ladder the different rate tiers at an 8 year break even.

Agreed with @ekREV98

. Go for the 20. You're used to making the payment now. Don't go backwards and reset the clock when you can lock in a great rate.

If I had to bet, I would say rates will go even lower within the next year, so you might even be able to get a better deal if the economy goes south.

When you factor in what you will save, it should effectively cost you nothing. I typically expect a break even of 2-3 years if I'm going to pursue a refi if I have any costs.

Refi that thing yesterday! Rates are at least a full percentage point below that and dropping.4.625 and have 27 years leftDepends on your situation. What's your rate and term currently?Rates gonna drop even more?

Refi now or try to wait it out a bit?

- Jan 19, 2002

- 23,520

- 5,672

Aright here's my dilemma, need to make a decision this week

-I still owe 27 years

-refi at 20 years and pay additional $40 to what I'm paying now per month

-refi at 30 years and save about $180 per month

If I did the 30 years, and sent the additional $220 a month (180 I'm saving + extra 40) would I essentially also pay it off in 20 years?

Just thinking about having a backup plan just in case I'm right on funds I can cut back and save those $220 monthly

-I still owe 27 years

-refi at 20 years and pay additional $40 to what I'm paying now per month

-refi at 30 years and save about $180 per month

If I did the 30 years, and sent the additional $220 a month (180 I'm saving + extra 40) would I essentially also pay it off in 20 years?

Just thinking about having a backup plan just in case I'm right on funds I can cut back and save those $220 monthly

- Oct 19, 2004

- 2,358

- 595

^ do you know what rate you'd get at 20 years vs 30? Id do that 20 if its in your budget

- Jan 19, 2002

- 23,520

- 5,672

3.375 vs 3.75

Loan officer told me if I sent the extra 220 a month like I'm planning to, it would essentially pay off in 20 years

I might be switching jobs soon so the 30 year option (with sending extra $240) entices me just in case things don't work out, I can go back to a lower payment

Last edited:

- Apr 17, 2006

- 1,146

- 131

Nice! What area?

I got a Mortage officer in Rockland County (on the upswing), a experienced investor in Putnam County and a few people around Westchester County all in NY. I just want to make a nice amount to where I have enough passive income to retire soon.. Looking at the Florida markets now..

- Nov 16, 2001

- 3,949

- 1,197

You'll be paying a several thousand more over 20 years by picking the 30 year loan, but you'll have more flexibility. On the other hand, if you pick the 20, you're forced to pay it off in 20 years instead of taking money from your mortgage payment for other expenses and extending the life of your loan.@Super T1ght

3.375 vs 3.75

Loan officer told me if I sent the extra 220 a month like I'm planning to, it would essentially pay off in 20 years

I might be switching jobs soon so the 30 year option (with sending extra $240) entices me just in case things don't work out, I can go back to a lower payment

- Jan 19, 2002

- 23,520

- 5,672

- Jul 27, 2012

- 1,563

- 1,828

Again, i would do the 20 yr loan. You are knocking 7 years off of your loan for $40 more.@Super T1ght

3.375 vs 3.75

Loan officer told me if I sent the extra 220 a month like I'm planning to, it would essentially pay off in 20 years

I might be switching jobs soon so the 30 year option (with sending extra $240) entices me just in case things don't work out, I can go back to a lower payment

From experience, i have a lot friends/family who I've done loans for and they say they will pay extra towards their mortgage to pay it off faster. And you know how many of them continue to pay extra? NONE. lol. They get caught up w/ the savings and they tell themselves "I'll pay more next month...next month rolls around, and they use the money for something else" I'm not saying this will be you but if your concern is savings, go for the 30 yr. Especially since you said you are switching jobs.

wavy daddy

Banned

- Feb 21, 2016

- 4,667

- 2,148

Man the housin market in houston seems like its goin up up up up everytime i look for something. Especially in my area, wont find anything decent under $250k then you cross the freeway and your lookin at minimum $750k

I can find something great for 175,200k 15-30 miles away in any given direction, but im. not tryna have a 45 min to 1 hr commute one way daily. Plus my zip code and surrounding, is zoned to great schools. Gotta factor that in to this whenever im searching.

I can find something great for 175,200k 15-30 miles away in any given direction, but im. not tryna have a 45 min to 1 hr commute one way daily. Plus my zip code and surrounding, is zoned to great schools. Gotta factor that in to this whenever im searching.

- Aug 21, 2005

- 8,915

- 2,688

Man the housin market in houston seems like its goin up up up up everytime i look for something. Especially in my area, wont find anything decent under $250k then you cross the freeway and your lookin at minimum $750k

I can find something great for 175,200k 15-30 miles away in any given direction, but im. not tryna have a 45 min to 1 hr commute one way daily. Plus my zip code and surrounding, is zoned to great schools. Gotta factor that in to this whenever im searching.

What part of Houston you trying to be in? Im looking right now as well in Houston.

- Nov 16, 2001

- 3,949

- 1,197

I'd probably do the same as @ekREV98 and get the 20. If you have extra income one month, you can always sock it away in case you need it for those lean months.@crcballer55

What would you do?

I used to have an "extra money" envelope for cash I didn't spend that month on groceries or eating our. Whenever it got over $500, we would drop it down to $100 and put the rest towards the mortgage.

- Jun 24, 2005

- 17,334

- 3,645

Thinking about doing the bi-weekly mortgage payment. My first mortgage payment is coming up next month, so I'm trying to figure out the steps needed to get this going. I assume the mortgage company will not just let me make half payments without getting some agreement together.  Does anyone have experience with this?

Does anyone have experience with this?

I'm on a 30-year fixed and the biweekly payments (with putting an extra $100 down each month) should knock it down to being paid off in 23-24 years. Also, I'm trying to put as much equity into the house as I possibly can within the first 5-7 years.

Does anyone have experience with this?

Does anyone have experience with this?I'm on a 30-year fixed and the biweekly payments (with putting an extra $100 down each month) should knock it down to being paid off in 23-24 years. Also, I'm trying to put as much equity into the house as I possibly can within the first 5-7 years.

Last edited:

- Nov 16, 2001

- 3,949

- 1,197

Ya... Don't do it. Just make an extra 1/12 payment each month. I have yet to find a company that won't charge for the "privilege" of making bi-monthly payments. IMO, it's a scam since you can easily do the same thing yourself.Thinking about doing the bi-weekly mortgage payment. My first mortgage payment is coming up next month, so I'm trying to figure out the steps needed to get this going. I assume the mortgage company will not just let me make half payments without getting some agreement together.Does anyone have experience with this?

I'm on a 30-year fixed and the biweekly payments (with putting an extra $100 down each month) should knock it down to being paid off in 23-24 years. Also, I'm trying to put as much equity into the house as I possibly can within the first 5-7 years.

I actually had a rep chew me out for not wanting to go through with it. I was like, seriously?! You want me to pay an extra $20/mo. PLUS setup fee just so I can do that? Get out of here! That's why you work at that call center kid.

Plus, from what I've been told from multiple sources they hang on to the extra principle payment for a quarter or half year and then apply it to the principle.

Last edited:

- Jan 19, 2002

- 23,520

- 5,672

Bhzmafia

I tried to do the same a few years ago. I was just sending the payment. A month and a half into it I called just to make sure it was applied. It was actually getting applied to the regular payment and whatever extra I had sent was in some "floating account."

Basically they were not applying it. They said they don't do it, you have to send your payment all at once. So check with your lender

- Jun 24, 2005

- 17,334

- 3,645

Good info fellas  I didn't even know about that.

I didn't even know about that.

I'll probably just do the 1/12 payment each month.

I didn't even know about that.

I didn't even know about that. I'll probably just do the 1/12 payment each month.

- Dec 1, 2011

- 4,323

- 4,705

Man the housin market in houston seems like its goin up up up up everytime i look for something. Especially in my area, wont find anything decent under $250k then you cross the freeway and your lookin at minimum $750k

I can find something great for 175,200k 15-30 miles away in any given direction, but im. not tryna have a 45 min to 1 hr commute one way daily. Plus my zip code and surrounding, is zoned to great schools. Gotta factor that in to this whenever im searching.

What part of Houston you trying to be in? Im looking right now as well in Houston.

Yall boys better set up shop in Katy

- Apr 30, 2010

- 69,985

- 106,936

free labor FTW

Thank you! I didn't even know BP had an IG account. lol. I started getting emails last week from people who were local to SD and they wanted to work with me. Told them i was looking for interns and they agreed to meet with me. Met with 2 people off of BP and hit it off and they are now interning for me. Both of them mentioned that they saw my name on BP's IG so i had to check it out myself and i was shocked when i saw my project on there. Truly thankful...

Free classes and experience depending on how you look at it. You get to see the game live. Granting this wouldn't mess with my full time, i'd jump on that chance.