Good morning ladies and gents,

are there any (lack of a better word or term) rules to abide by when considering buying a second home?

Im looking to buy a second home to rent out, like some have talked about on here for the investment/having a bit income/gaining of wealth by having someone pay the rent on the second home.

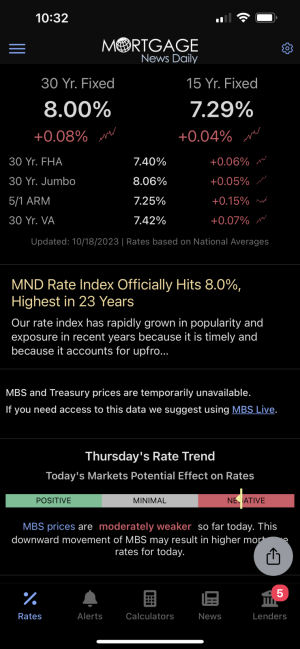

Im talking the rules like "not spending more than 33% of your income on housing," debt to income ratio, or rules of savings put away that need to be considered.

I know the bigger pockets site is often referenced, so i am going to dedicate some real time to reading up on it there (starting here,

https://www.biggerpockets.com/real-estate-investing/) just curious if you guys have any stead fast rules yall believed should be followed?