was just reading this and couldn't agree more.

been crazy these past few months for me and my fam, the house we're renting in was foreclosed so we're in the process of looking for a new place. either renting or buying.

the only realtor we knew was my dad's when he bought a house a few years back so we went with her. We told her our info and how much downpayment we had and our criteria for a house, which was it has to be in SF or possibly DC but close to SF. but nah, she kept pushing for condos since "that is what we could afford in our budget". after a few weeks we had it with her and the listings she was showing us because it was neither in SF nor DC but further out. we pretty much gave up looking to buy and decided to go back to looking for a place to rent. luckily we found our current realtor at one of the places for rent that they were managing. couldn't have asked for more for a realtor, responds quickly, and sticks with our criteria.

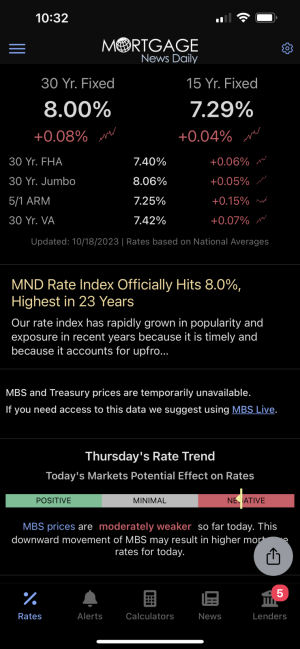

initially me and my mom were pre-approved for 400k only, mom's credit score was high 790s low 800 in one of the bureaus. mine was 740-750. that amount won't get us anything in San Francisco, my sister's score was around 650

my brother stepped in and wanted to co-sign as well which raised it to 650k rate is 4.5% though but really all we could afford on our monthly mortgage is below 4k.

question for you guys here, since our downpayment is only 10% will we have to pay PMI? and if so, is that for the life of the loan? the realtor's assistant said it should only be for a year to pay PMI but she's not the realtor nor the lender so idk if I can take her word on that.

there's so much idk and it feels like I'm being left out of the process since my mom and sister are real close, I'm really only there for open houses but meetings with the realtor or the lender it's just those two. it's frustrating since english is my mom's 2nd language and doesn't understand much of the technical jargon (neither do i really), and my sister isn't even gonna be on the loan but they're talking to her like she's the one in charge between all of us.

lastly, is there any sites where I can read more about first time home buyers? maybe something easy to understand.