- 43,425

- 42,998

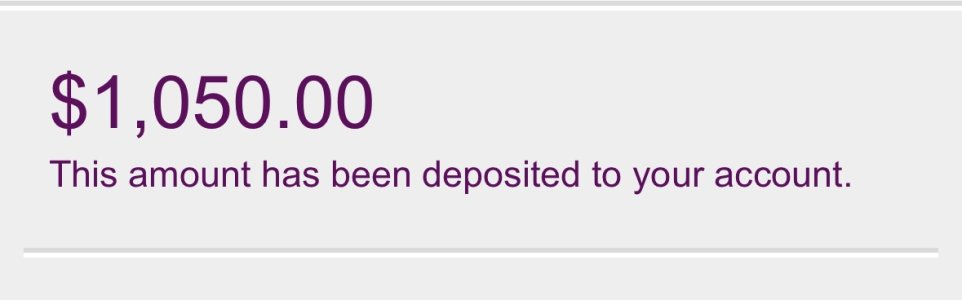

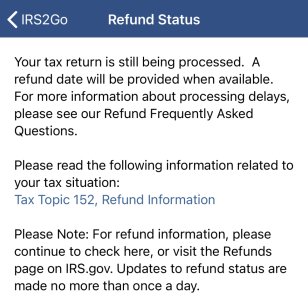

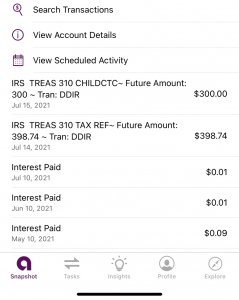

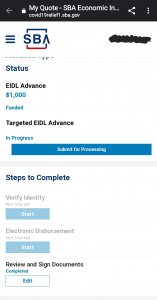

True. Cost of lining in America needs to account for 3 major things, healthcare, taxable wage and housing. So many jobs offer the bare minimum health care of that at all.For some people 50k is actually 45k after taxes. On other hand there’s quite a large population where 50k is actually 35k after taxes, healthcare etc. Now if your spouse doesn’t make much but also does not qualify for a check, how is that going to work