- 13,736

- 17,485

- Joined

- Jul 16, 2017

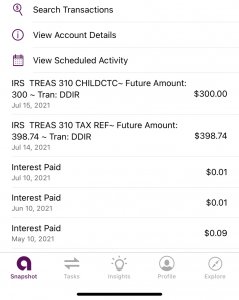

I wouldn’t return that **** **** that. They made sure immigrants without citizenship and people married to them don’t receive the checks but they sending out checks to dead people? **** that take it as a blessing and keep it pushing. People always gotta snitch on themselves

IRS stimulus checks sent to millions of dead people, Treasury Dept. wants them back

By Michael Finney and Renee Koury

Updated 31 minutes ago

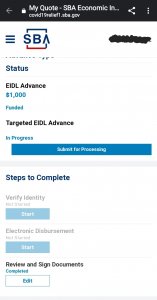

SAN FRANCISCO (KGO) -- We've told you about the millions of Americans still waiting for a stimulus payment. Now we're finding that many families received too many checks. The government is sending stimulus checks to possibly millions of dead people. Their families don't know what to do with them, so they came to 7 On Your Side.

It's quite a shock for grieving families to receive these checks for a loved one who died. It's because of a quirk in a section of the CARES Act that defines who's entitled to a check.

We told you earlier about Robert Lentz of San Francisco. He lost his wife Jacklin to brain cancer two years ago. And now, an eerie reminder.

"It's one of those things that you don't expect to come out of nowhere," Lentz said.

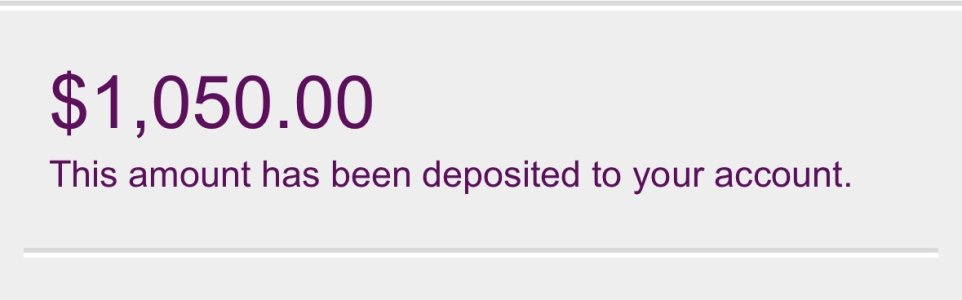

To his shock, Robert discovered a stimulus check in Jacklin's name deposited in his bank account.

And he isn't alone.

Terry in the East Bay writes, "My father died April 3 and yep, Wednesday his stimulus check for $1,200 was right in his account."

Daryl in the South Bay writes: "My mom passed away a little over a year ago. Today I get a $1,200 check made out to her."

CPA Jim McHale says the IRS is sending out stimulus payments to untold numbers of dead people across the country. "Hypothetically every person who died following the filing of a tax return in 2018 will be receiving a check," McHale says. "I'm guessing it's in the millions, the low millions."

Why is this happening? Under the CARES Act, Americans receive a check based solely on their tax returns for 2018 or 2019. So if a person died after filing a return in those years, chances are they're getting a check.

"Under the letter of the law, if you filed a tax return in 2018 or 2019, the law says you're entitled to this payment. They drafted these laws so quickly it didn't say 'but if you die in the interim, you're not entitled to a payment,'" says McHale.

McHale says the IRS computer system is so outdated it couldn't filter out taxpayers who have died.

"They are still using computers with black screens and green letters," he says.

Previously an IRS spokesperson told 7 On Your Side the agency had no rules on what loved ones should do with the extra payment. However, Treasury Secretary Steve Mnuchin recently told The Wall Street Journal that families must return the money.

"The final word on this is not out. We believe based on Mnuchin's comment... they expect to get the money back," says McHale.

And a general IRS rule warns the agency could charge interest and penalties on any payment the IRS makes to you by mistake. McHale recommends returning these checks.

"You could end up having to pay back, say $1,500, $1,600 on a $1,200 check if it ran its whole course," he says.

But returning a payment can be a hassle. According to the IRS, overpayments should be mailed back or reversed at the bank. Then consumers should call the IRS to say why it was sent back.

Try doing that when offices are closed.

"It's always better to nip it in the bud and always better not to have a problem with the IRS in the long run, and stay on their good side. And if you received a payment, especially if you want to return it to help everyone out in this time of crisis," McHale says.

Some CPAs advise hanging on to the payments till the IRS tells you what to do with them. 7 On Your Side will let you know when the directive comes out.

these again. I only saw the thighs in the pic preview at the bottom and was like

these again. I only saw the thighs in the pic preview at the bottom and was like