- 4,266

- 4,298

- Joined

- Jul 20, 2012

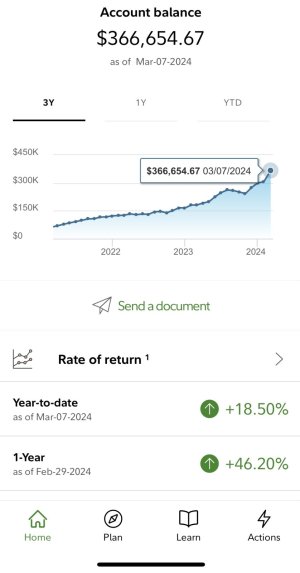

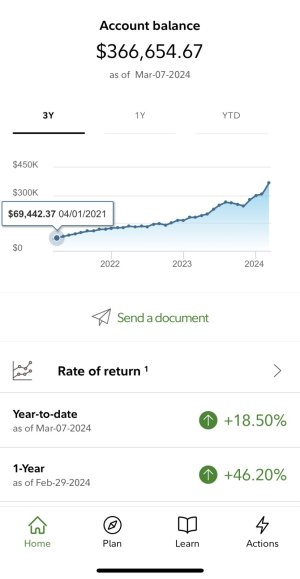

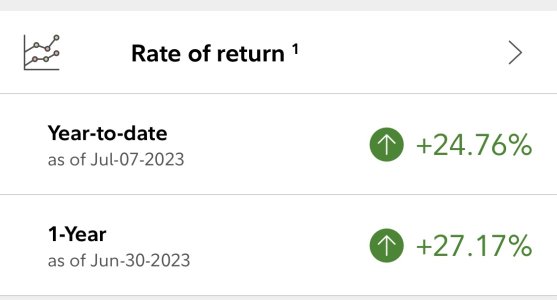

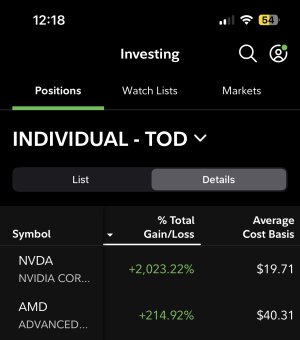

If you literally bought anything in 2010 and the company didn’t go bankrupt you made at least double your money if you held until today. Buy and hold is proven to pay off if you invest in good companies with strong earnings year over year.

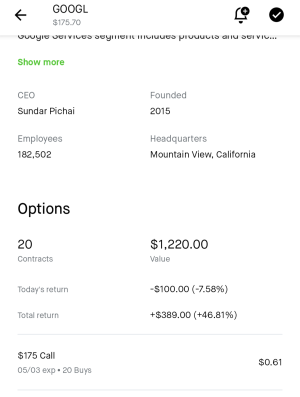

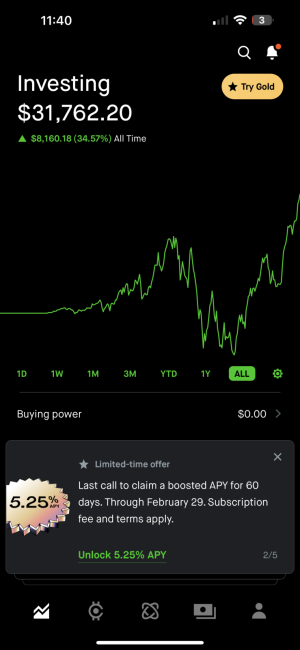

Idk how taking profits in stages is silly. You’re literally locking in gains and if you are adding back on dips, you’re winning immensely in the long run. Read William O’Neill’s book if you haven’t.

I feel ya

But nah I’m good

Might still check out that book what’s the title