- Aug 19, 2015

- 8,317

- 7,167

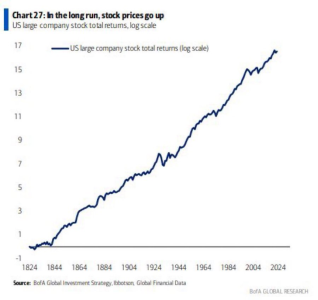

My thought is if you categorize yourself strictly as a long term investor, as Puru is, then that means you're not really making money on investing (to pay bills and have cash). But you're growing the value of your portfolio for whenever the day comes that you'll sell...

Shouldn't be investing with money that you "need" to pay bills with. If you go down the "FIRE" (Financial Independence / Retire Early) rabbit hole, what most people are trying to accomplish is reaching a certain value that allows them pull 3-4% out per year as a "safe withdrawal rate". The people on reddit frequently cite the "Trinity Study" which states you can pull that 3-4% SWR every year, and the remaining ~96% in your portfolio will continue rising in value to where you are basically treading water, or at least not ripping through your portfolio too quickly. Many people's FIRE goal is in the $2-3m range, as 4% of $3m is still $120k a year you can pull out. Even if your $3m didn't continue rising in value and only stayed stable, you could pull out $120k a year for 25 years straight.

Thats obviously not all investors though, that is for the people that are trying to stack as much as possible, as quickly as possible into their careers - so then they can be financially free.

)... and then not buying a few months back when it almost dipped to $200 (which is the level I said I'd get in at

)... and then not buying a few months back when it almost dipped to $200 (which is the level I said I'd get in at  . Also missed out on what would have become some insane real estate appreciation in Detroit, after getting talked out of it (though back then, Detroit was still pretty rough).

. Also missed out on what would have become some insane real estate appreciation in Detroit, after getting talked out of it (though back then, Detroit was still pretty rough).