D

Deleted member 42060

Guest

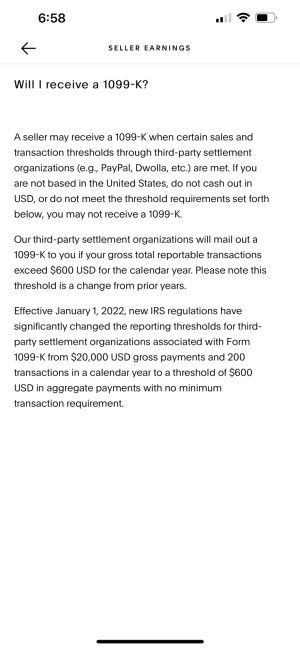

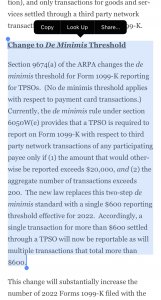

Basically no other way to avoid paying taxes on things 600 and up. If you wanna list everything $599 and under, then that’s an option  . Still if it adds up to $20G you will get the 1099K.

. Still if it adds up to $20G you will get the 1099K.

. Still if it adds up to $20G you will get the 1099K.

. Still if it adds up to $20G you will get the 1099K.