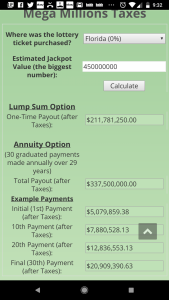

- 47,242

- 96,766

- Joined

- Mar 19, 2013

Pull up b.

I might not even come out the house to deal with you. Might just send my mans Bobby Hill outside wit da bag, and dare you to try him.

I got a plate of "louie anderson" to keep Booby busy.

Show yourself Gribble