So, to be clear, you put your money away into something that you claim is inherently risky, you could lose everything, and you won't see any of it (if it still exists) until you're 59.5?i have a 401k, guess what? completely irrelevant what im talking about.

you don't risk a solid annuity with a hard number long term, that's inflation proof based on da interest rates to chop yourself at da knees for "maybe money".

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: this_feature_currently_requires_accessing_site_using_safari

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

20 yo won the mega millions jackpot

- Thread in 'General' Thread starter Started by antbanks81,

- Start date

- 14,228

- 21,062

- Joined

- Aug 22, 2012

"Dirty pool mister, dirty pool"Pull up b.

I might not even come out the house to deal with you. Might just send my mans Bobby Hill outside wit da bag, and dare you to try him.

- 70,049

- 24,223

- Joined

- Aug 1, 2004

So, to be clear, you put your money away into something that you claim is inherently risky, you could lose everything

you're deliberately being misleading help your narrative. you can arrange your 401k to be as conservative and "solid" and shield yourself from risk as much as possible, and my employer also matches my contributions.

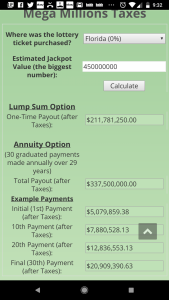

da lotto annuity payments, are gold plated returns protected by interest rates to match da future value against inflation.

being a thirst bucket to have a large lump sum but overall smaller windfall is stupid, because you're lifestyle as a millionaire doesn't change once you enter that stratosphere of riches.

i rather secure my spot there over a long period of time.

Carmelo Anthony & Alex Rodríguez dont live less better than Bloomberg or Donald Trump... imagine making what A-Rod makes annually for 30 years... complete no brainier, and if you wanna play a couple of years with investments? knock yourself out..you don't jeopardize da whole golden goose.

Yes, this is how investment works. Thank you for proving me and antidope's points. The only reason you would call me misleading is because you don't understand investing.you're deliberately being misleading help your narrative. you can arrange your 401k to be as conservative and "solid" and shield yourself from risk as much as possible, and my employer also matches my contributions.

That's fine. No one said that is wrong. What is wrong is your claim that people are idiots for taking the lump sum or that they're throwing away money. It depends.i rather secure my spot there over a long period of time.

RustyShackleford

Supporter

- 64,047

- 192,217

- Joined

- Jul 20, 2009

I know the payments increaseno they're not, they go up over time to reflect da future value based on da inflation rate...30 years of "set it and forget it" payments that give you nearly everything you won >*

When I say fixed I mean at the time of agreeing to the annuitity, do you know exactly what you be getting every year, or do you have wait for some inflation adjustment for you to know you exact amount?

Like at year zero, do I know exactly what my payments will be in year 21? Or nah?

Are they explicitly tying it inflation year over year, or just assuming an average inflation rate over the time period and calculating out the payments from there. I am asking you a question, because that difference matters.

- 9,201

- 14,873

- Joined

- Jul 30, 2017

I would be smart about my money if I won but no doubt im either buying ferrari or a s550 coupe..and im blowin hella bread on whores lol

- 36,368

- 29,283

- Joined

- Jul 22, 2012

It would be nice to win the lotto.

$tacy

formerly willchamberlain

- 26,191

- 25,014

- Joined

- Nov 24, 2012

I hope u would leave dusty *** Ohio. Move cedar point and blow the whole state up wit yo cashI would be smart about my money if I won but no doubt im either buying ferrari or a s550 coupe..and im blowin hella bread on whores lol

- 9,201

- 14,873

- Joined

- Jul 30, 2017

**** i would hope you would buy some street lights for your city lol

- 70,049

- 24,223

- Joined

- Aug 1, 2004

What is wrong is your claim that people are idiots for taking the lump sum or that they're throwing away money.

when u take da lump sum you ARE throwing money away, cuz you're not getting anywhere near what you want at da expense of getting more at once.

- 70,049

- 24,223

- Joined

- Aug 1, 2004

Are they explicitly tying it inflation year over year

this is what they're doing, so if u get da payments you'll get that minus da tax rates, which is way more then da lump sum over time.

Why do you think you should max out your 401k contributions, especially while you're young, if you want to maximize your returns by the time you retire? Investing more money leads to more returns.when u take da lump sum you ARE throwing money away, cuz you're not getting anywhere near what you want at da expense of getting more at once.

- 2,214

- 316

- Joined

- Apr 1, 2005

I could care less about any of that. I will immediately throw my cellphone in the garbage and buy a ticket out the country. I will make sure my immediate family is set but other than that they on their own. F*** everyone else. I´m a selfish, ruthless bastard already so most people that know me know that they ain´t getting ish from me

antidope

Supporter

- 62,841

- 66,337

- Joined

- Jan 2, 2012

I max mine and I highly recommend everyone does the same. Just for arguments sake...Why do you think you should max out your 401k contributions, especially while you're young, if you want to maximize your returns by the time you retire? Investing more money leads to more returns.

PV - $0

PYMT - 18,500

I/Y - 6%

N - 30

Gives you 1.4MM

You take the 280MM that this kid does and do the same thing with 100MM of it and do...

PV - 100,000,000

Pymt - 0

I/Y - 6%

N - 30

And you get... FIVE HUNDRED AND SEVENTY FOUR MILLION DOLLARS.

This is the point we have all been making. And I'm taking 6% when the per annum inflation adjusted returns for the S&P 500 is 8% if I remember correctly.

Last edited:

- 70,049

- 24,223

- Joined

- Aug 1, 2004

Why do you think you should max out your 401k contributions, especially while you're young, if you want to maximize your returns by the time you retire? Investing more money leads to more returns.

investing isn't da panacea you're making it out to be, especially not enough to sacrifice da back end money da lottery annuity payments promise.

- 2,312

- 1,573

- Joined

- Sep 6, 2013

I know ninja is the butt of a lot of people’s jokes here, but I swear some of you guys like to argue with him just because  . Like dude is making valid points and y’all coming at him like he’s speaking gibberish lol. Yes, you could take the lump sum and invest the whole thing, but who honestly would? Warren Buffet wouldn’t even tell you to do that

. Like dude is making valid points and y’all coming at him like he’s speaking gibberish lol. Yes, you could take the lump sum and invest the whole thing, but who honestly would? Warren Buffet wouldn’t even tell you to do that  . You could get killed 10 days after taking the lump sum and then what? So much for your investments. At least with the payments you can have the money paid out over time to your estate ensuring your heirs or next of kin can’t squander it all after you’re gone (assuming they’re not the financial wizards or investment gurus some of the people sound like in here

. You could get killed 10 days after taking the lump sum and then what? So much for your investments. At least with the payments you can have the money paid out over time to your estate ensuring your heirs or next of kin can’t squander it all after you’re gone (assuming they’re not the financial wizards or investment gurus some of the people sound like in here  ). That’s generational wealth.

). That’s generational wealth.

. Like dude is making valid points and y’all coming at him like he’s speaking gibberish lol. Yes, you could take the lump sum and invest the whole thing, but who honestly would? Warren Buffet wouldn’t even tell you to do that

. Like dude is making valid points and y’all coming at him like he’s speaking gibberish lol. Yes, you could take the lump sum and invest the whole thing, but who honestly would? Warren Buffet wouldn’t even tell you to do that  . You could get killed 10 days after taking the lump sum and then what? So much for your investments. At least with the payments you can have the money paid out over time to your estate ensuring your heirs or next of kin can’t squander it all after you’re gone (assuming they’re not the financial wizards or investment gurus some of the people sound like in here

. You could get killed 10 days after taking the lump sum and then what? So much for your investments. At least with the payments you can have the money paid out over time to your estate ensuring your heirs or next of kin can’t squander it all after you’re gone (assuming they’re not the financial wizards or investment gurus some of the people sound like in here  ). That’s generational wealth.

). That’s generational wealth.antidope

Supporter

- 62,841

- 66,337

- Joined

- Jan 2, 2012

That's not how investments work. The money doesn't disappear upon your death. I'm Pretty sure the annuity does. Set up various trusts, add TOD, etc etc.

And you dont need to invest the whole thing. There is 100 years of historical precedent and basic math that tells you that tells you that you can easily make more money with the lump sum.

And you dont need to invest the whole thing. There is 100 years of historical precedent and basic math that tells you that tells you that you can easily make more money with the lump sum.

- 36,573

- 48,787

- Joined

- May 12, 2008

This gonna be me if I ever win.

You keep dodging questions about the 401k. Why do you put money into it? What do you think the point of a 401k is? Why do you think people try to maximize their contributions, especially while they're young?investing isn't da panacea you're making it out to be, especially not enough to sacrifice da back end money da lottery annuity payments promise.

- 2,312

- 1,573

- Joined

- Sep 6, 2013

That's not how investments work. The money doesn't disappear upon your death. I'm Pretty sure the annuity does. Set up various trusts, add TOD, etc etc.

And you dont need to invest the whole thing. There is 100 years of historical precedent and basic math that tells you that tells you that you can easily make more money with the lump sum.

Annuity payments continue after death

antidope

Supporter

- 62,841

- 66,337

- Joined

- Jan 2, 2012

That's news to me. Doesn't erase the point I made or the math though. Someone provide a good counter to the math and I will concede.Annuity payments continue after death

- 14,173

- 6,430

- Joined

- Feb 4, 2012

I didn't take a look at the details of the annuity and all.

But it's usually ALWAYS better to take the money and invest it yourself.

With that said, annuity will ensure you don't go broke and lose yourself in a unsustainable lifestyle.

But if you are smart with it, taking the money is the move.

But it's usually ALWAYS better to take the money and invest it yourself.

With that said, annuity will ensure you don't go broke and lose yourself in a unsustainable lifestyle.

But if you are smart with it, taking the money is the move.

- 21,880

- 18,052

- Joined

- Mar 9, 2010

Quit my job? Bruh.

- 21,880

- 18,052

- Joined

- Mar 9, 2010

Not even joking. I would kill everyone in this thread for 20 million. Wouldn't even feel an ounce of guilt either.

Question: would y'all still post on NT?

- 157,488

- 137,483

- Joined

- Oct 13, 2001

#MagicJohnsonTweetIt would be nice to win the lotto.