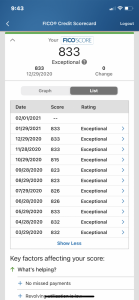

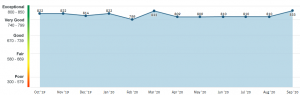

What did you do to get the increase in score if you don't mind me asking

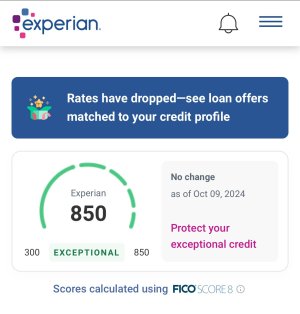

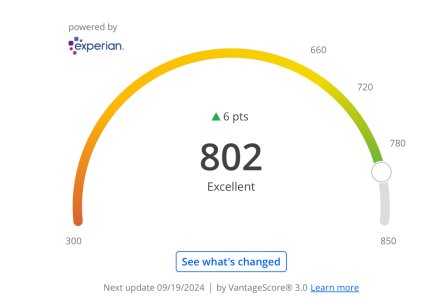

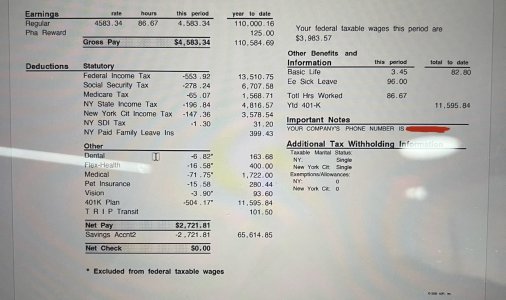

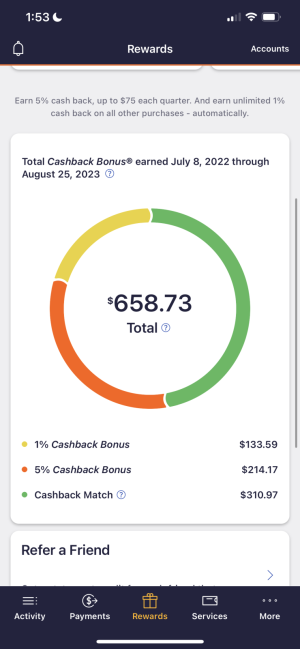

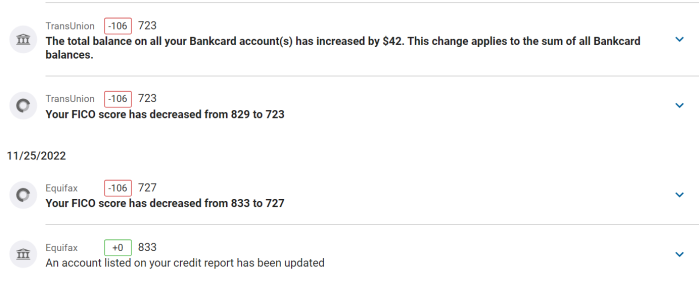

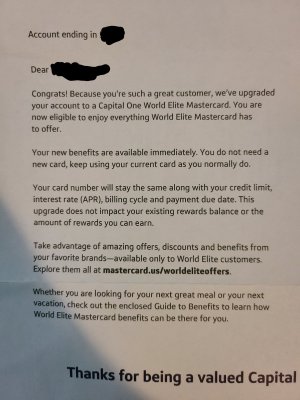

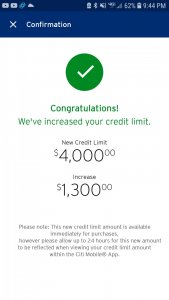

At the time me and my girl were moving. I didn't have bad credit, I just had no credit. So I put everything in my name, apartment, lights etc. Someone here recommended credit karma I think or some sight that helps u find a card that will accept u. Only 2 people gave me carsd, Walmart(150 limit) and capital one (300 limit). I axed them things out the same day. Paid em off in full every month. Max em out, pay em off, paid every bill on time. Then around Xmas borrowed 500 from my credit union.

I tried to lease a truck last year and the guy basically laughed. Told me I had a 440 and needed a co signer. Went Friday, left with the truck 30 minutes later no co signer.