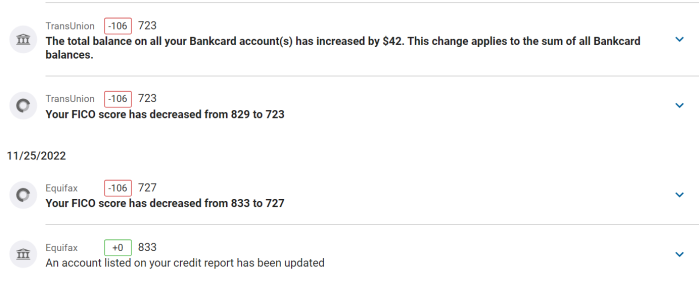

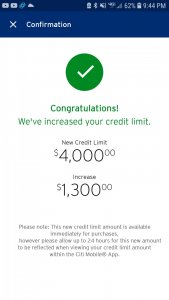

- 10,915

- 2,735

Just signed up for the Hyatt Card. 2 free nights ANYWHERE. Finna book a room at their all-inclusive hotel in Cancun

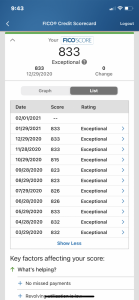

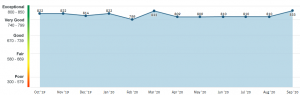

$11k credit limit instant approval

$11k credit limit instant approval

Last edited: