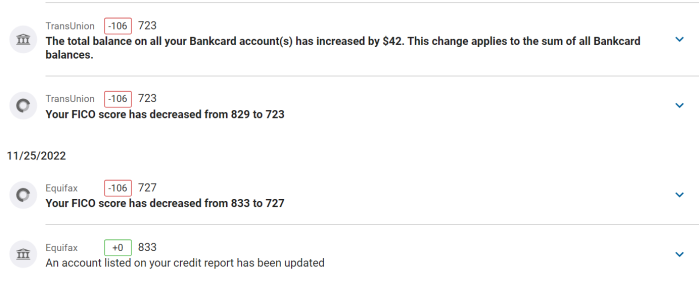

So I have a decent amount of money on the way due to a tax refund and I am looking to pay down some old bad debt. All 3 agencies are showing that I have two entries for past due/bad debt. One is From Capital One and the other from Portfolio Recovery Assets.

Does anyone have any history with this? Can I simple call Cap One and PRA to negotiate a settlement amount and have it removed from my credit score?

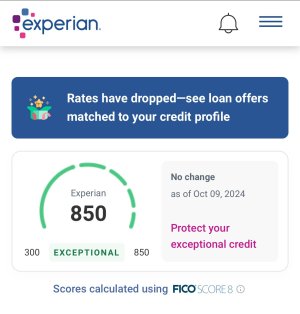

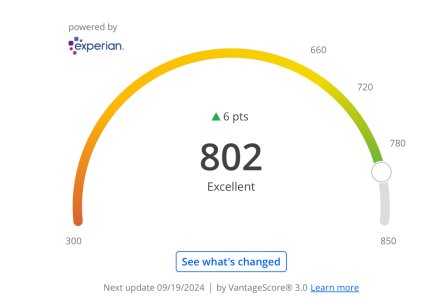

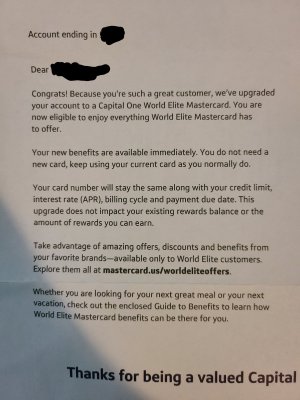

I have received this info via a Wells Fargo identity theft program(the picture below) I'm enrolled in, so I don't know if there is more info available than this. Is there a way for me to find out when the debt was initially originated, when it's due to be charged off and who is actually the owner of the debt.

I'd really appreciate any info or insights anyone has. PMs are welcome if you'd prefer to keep it private.

Thanks!

View media item 1999556