- 12,986

- 5,248

- Joined

- Jul 18, 2012

Crc said most of what needs to be said.

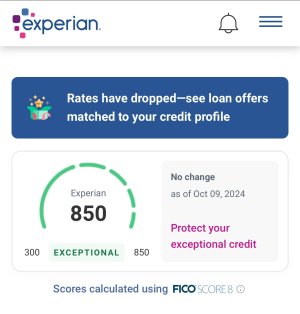

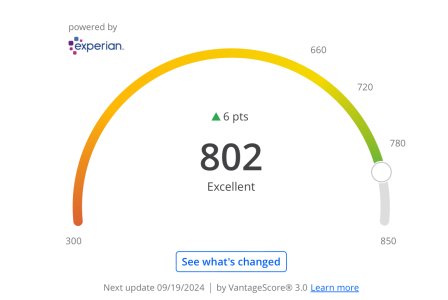

But as a rule of thumb... if u want a nice house... you need nice credit

After the 08 madness its considerably harder to get approved for home loans. Youd hafta have a HIGH income to even be considered without the backing of a solid credit history

Now if u have ither assets you want to put up or if the property value is lower its less of a concern but in 2015 if your looking to borrow hundreds of thousands the bank wants to know your worth it. They dont make money reposessing your home and taking on the responsibilty of maintaing it until it sells for less than its worth. Or worse letting it sit and kill the property value of surrounding homes

First time home buyers get a GANG of benefits i wont go into if its gunna be an investment vehicle.

But as a rule of thumb... if u want a nice house... you need nice credit

After the 08 madness its considerably harder to get approved for home loans. Youd hafta have a HIGH income to even be considered without the backing of a solid credit history

Now if u have ither assets you want to put up or if the property value is lower its less of a concern but in 2015 if your looking to borrow hundreds of thousands the bank wants to know your worth it. They dont make money reposessing your home and taking on the responsibilty of maintaing it until it sells for less than its worth. Or worse letting it sit and kill the property value of surrounding homes

First time home buyers get a GANG of benefits i wont go into if its gunna be an investment vehicle.

Last edited: