Selling my crib in Brooklyn nyc...

covid is Killing me.. not that I can’t find buyers, but they are low balling and using covid and low renters available ( I owns stand alone home that investors WILL turn the lot into a 6/7 story building) as a reasoning.

i don’t wanna go under a magic number but I can’t take nyc anymore. And the rich cats are snatching up homes in upstate nyc, where I wanna go. SMH

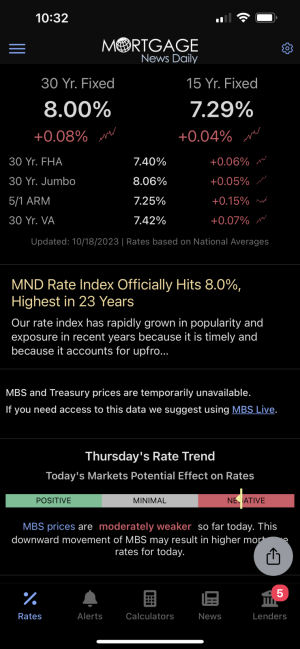

for reference, I’m asking $1.25M... anything under 1.1M I’m asking for residency in the new build with a 5 year lease for free

I can imagine real estate values in NYC/San Fran/LA plummeting with so much more work being done remotely

I can imagine real estate values in NYC/San Fran/LA plummeting with so much more work being done remotely