- Aug 19, 2015

- 8,333

- 7,198

Airbnbs have a place depending on what you are doing and where. Overnight ski trips they are usually way more affordable than hotels in ski towns. And always check Airbnbs when traveling abroad. You may pay less or at the very least get more value for your money. Again, depends on where you are going and what you’re doing.

All things being equal I prefer [nice] hotels.

Yep, and another thing that airbnb / vrbo offer is your own kitchen and amenities. When I'm on ski trips, I'm not trying to sit down somewhere and eat breakfast before I hit the slopes. We used to do a Super Bowl house ski weekend in the mountains every year, some years we'd have 30+ people and rent out a 6000sqft lodge. Hotels are fine for yourself + partner or small groups, but if you want to spend time together with your own space - cant really get that at a hotel. Not gonna have you and your boys or family hanging out in the hotel lobby before you all go back to your separate 300sqft rooms for the night.

I am also aware of the flaws for those types of rentals, too. If I'm paying a cleaning fee, then you clean it mf. And all of the other ******** fees they charge where it becomes not even worth it anymore.

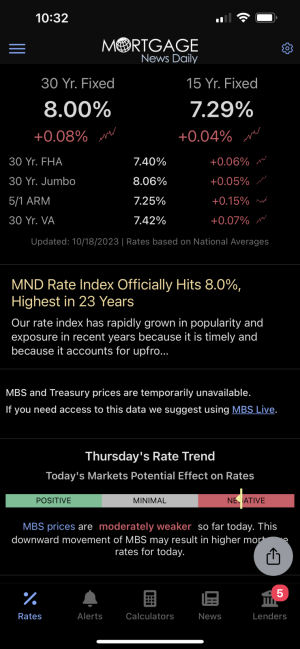

My contractor says he can get the place looking new for 10k-12k. Going to rent it for $1k after it's done.

My contractor says he can get the place looking new for 10k-12k. Going to rent it for $1k after it's done.