- 586

- 1,020

- Joined

- Aug 5, 2017

Glad to hear it is working for you. Would be similar to brrrr, but I want to pay cash initially.Look into BRRRR method and search bigger pockets.

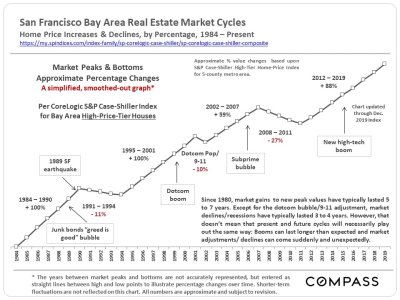

I bought a place for 60K cash last summer, put 30k into it. Refi'd 60k back out after appraisal. Took 45 bought an apartment building that was for sale off market at 250. Technically my original 60K got me 6 units.

Remember my market is cheap so this wouldn't work everywhere.

I'm looking to make roughly 6 figures on my next sale. Planning to use that money to buy another 4 units and a new primary residence for my family (selling current primary residence and renting for next 9 months). Should have my house sold roughly a couple days before my wedding in June.