Your confusion had me all confused

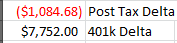

if your employer is matching 3% of your total salary, you have to contribute 3% to get that. If the total match is only 40% of what you've contributed, then you're contributing much more than 3% of your salary. Henny it looks like you're contributing ~7.5% of your salary right now (of which 3% is being matched)

Out of curiousity, do you know what firm is in charge of your company's 401k plan? For instance our company uses Merrill Lynch and I've found their online platform extremely easy to use. I can adjust my investment selections, contribution rate, etc etc online in a couple clicks. Extremely handy if you need to adjust your contribution rate especially.