- May 31, 2007

- 4,943

- 3,512

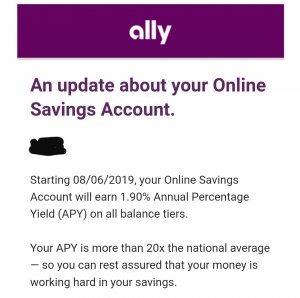

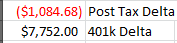

After establishing minimum contributions % to cash savings (a solid, but relatively small amount) and retirement, attack the debt. Look into 0% intro promos once the balance could reasonably be paid off within 18 months. Once you have debt, accept that it costs you more the longer you keep it. You can shop for rates to lessen the blow but make a plan to pay it off within x months and stick to it.I’m seriously considering paying off my car loan quickly. I have about 65% of the total cost of loan payoff in my high yield savings.

Should I pause my savings (I dump about $350-$400 weekly into savings) and attack the car loan or should I save enough to where my savings can pay off the car loan then start over saving?

Or maybe even do both? Still save little maybe like $200 weekly and use the difference to add to car note.

This is my only debt btw. No CC, student loans, etc.