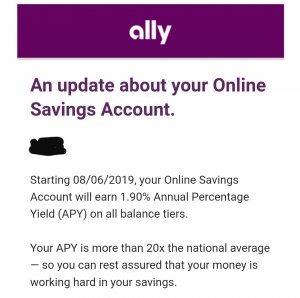

With an online savings account, the interest rate will be a lot higher than traditional banks but you're still earning close to nothing. Capital One 360 offers .75% & Ally offers 1%. Just found a bank called Northpointe in Michigan that is offering 5% up to $5000 as long as you swipe your card 15 times during the month and have direct deposit/direct debit. It's not the best interface, but the rate is unbeatable.

I have a credit union for those times when I need to walk into a branch, but have it connected to my online banks so I can easily transfer money back and forth.

"Qualifications include 15 or more debit card purchases in the aggregate amount of $500.00 or greater that post and settle per the statement period, enrollment in eStatements and direct deposit or automatic withdrawal of $100 or more per statement period. $100 minimum deposit required to open."

Can you elaborate a little more on this, would like to look into it.

- Basically you have to use your debit card at least 15 times per month, totaling a minimum of $500?

- Enroll in e-statements?

- If you choose not to open up a direct deposit with them, you have to have an automatic withdrawal of at least $100, would your monthly cable or phone count if it's over $100?