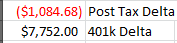

I'm looking to start an IRA account in the near future. I'm thinking of opening a lending club retirement account. I love the idea of making interest off of my money and it going into a tax deductible retirement account. Right now I really dont care about being aggressive with that money. I just want to put it somewhere safe. I'm really just doing it for the tax deduction.

thoughts ?

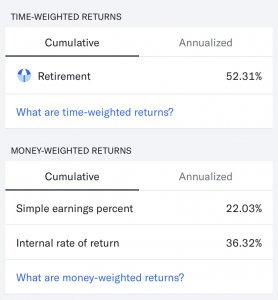

No. At this point in life be aggressive. You're not going to be pulling it for another 30 years and the difference in 1-3% annually over that time can be hundreds of thousands.

Personally, I've cooled to Lending Club over the past several months. I have had 3 accounts go into default after only a couple months of payments. One person took out the loan and didn't even try to make payments. Just took the money and ran.

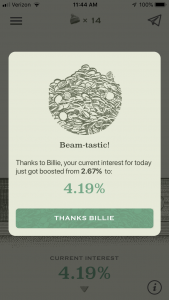

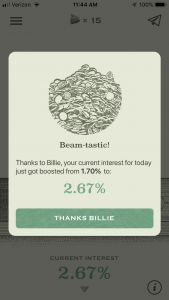

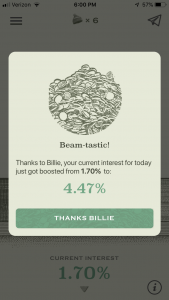

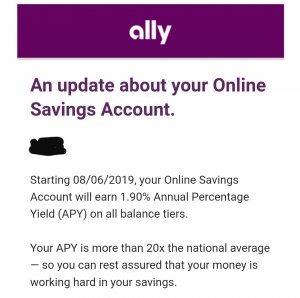

I set up my portfolio as a 9% target. So far, it's netting 3.44%. If you want to do it as an alternative to a savings account it can be a good option. But personally I would stay away from bond/debt type investing for retirement at this point in life.