Went through my yearly records and I took off 73 days of work this year

. Just people asking me if they can have my shift etc .. Definitely cost me between $7300-$9000 :x .. Can't lie I saved a little money and got lazy

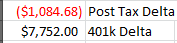

Saved $11,000 but I spent like $17,000

This was my first full year of keeping records of my income and it's pretty eye opening. I didn't know I spent THAT much. I still live at home so my only expense is like $3500/year for car insurance and like $600 for my gym. Should definitely be saving closer to $17k and not SPENDING that much

I made no less than $2000 and no more than $3000/month in 2016. I would just save $1000 then spend the rest on bills and "living. " Not gonna do that this year. Just gonna save up the whole month, then at the end of the month I'll pay off my cc, insurance, bills, etc, and save the rest. There's no way I should be making $2800 a month and only saving $1000 if my mandatory expenses are only like $800 max

Overall I'm happy. I wanted to save $12,000 (1k a month) but I made a conscious decision to spend and not save in December

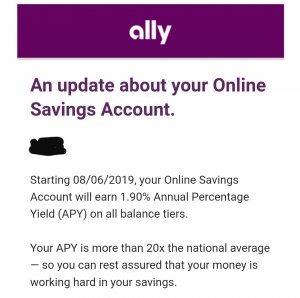

. I started saving in August of 2015 and I have close to 20k saved up. Goal this year is to change my spending habits (not spend as much) and also my saving strategy (MINIMUM of $1000 saved per month from now on) oh and not to take so many days off

).

).