- May 31, 2007

- 4,946

- 3,516

You’re only real options are to cash out, roll over into an IRA with current institution, or roll over into new employer’s plan. DO NOT CASH OUT!What do you guys recommend doing with a 401k from a former employee, besides rolling it over to your new company?

No reason I have in not doing it, just want to weigh my options.

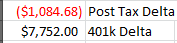

I recommend roll over into your new employer’s plan. If you NEED the money, and options are limited, you can do a 401k loan where you can take out up to 50% as a general purpose loan (if your plan allows it). Doesn’t show up on your credit report. You’re borrowing money from yourself. Rolling it over consolidates your 401k balances into one pot thus increasing the amount you can take out as a loan. You pay back the loan using after tax deductions from your paycheck. And you can still contribute pretax dollars to your plan. The interest you pay on the loan is going back into your plan/to yourself. Also depending on your plan, the loan doesn’t impact your 401k balance so you can still earn market gains even if you’ve taken a loan.

If you default, the loan is then considered an early withdrawal which becomes taxable income and you’ll have to pay the early withdrawal penalty. If you change jobs, and can’t pay the loan off within 60 days, you can continue to make payments via e-bank transfers.

I took a loan to settle some debt that was hurting my credit score and interest payments were kicking in. Process was quick and easy. The automatic deductions and the fact I’m paying myself back vs different creditors just feels like a better situation.