I just signed up for Beam account today, here are the basic terms (not all inclusive) copied from website:

1.1. General Information

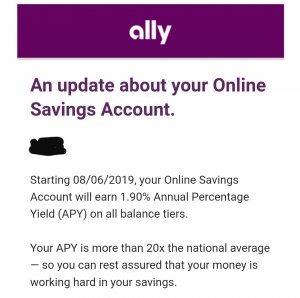

The funds in your Beam Account will be transmitted to FDIC-insured, interest-bearing accounts at one or more participating FDIC-insured banks (“Participating Banks”). You will earn interest on your funds at a rate set by Beam that will be customized based on the choices you make in the App. The minimum rate set by Beam as of the date of this Terms is

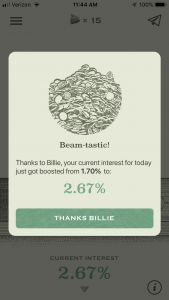

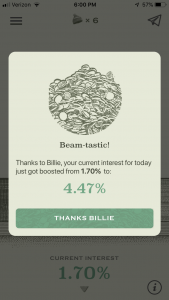

1.70% per annum. We reserve the right to modify the rates, at any time, based on macroeconomic changes to the Fed Funds Effective rate.

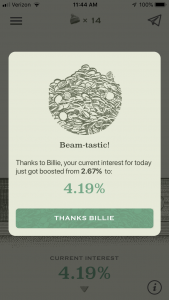

You can increase the rate above the minimum rate by the choices you make in the App, such as collecting free Daily Rate Reward (also described as “Billies” in the App), inviting friends to subscribe to Website’s mailing list, etc. The payout of each Daily Rate Reward is variable. With these Daily Rate Rewards, it is possible to increase the daily rate up to

7.00% for each day. The daily rate will be reset to the minimum rate at the beginning of the following day. The effect of such Daily Rate Rewards can noticeably increase your earnings from the Beam Account, which will be credited to you on a daily basis and subject to the available-for-withdrawal balance as disclosed in the App. We reserve the right to modify, at any time, the methods for earning the Daily Rate Rewards, which will be disclosed in the App.

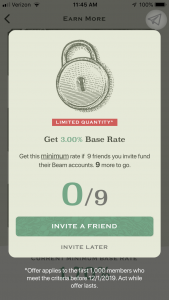

You can also increase the minimum rate, which will not be reset, by participating in various promotions, the terms of which will be disclosed in the App. The resulting elevated minimum rates (“Rate Tier”) received in these promotions may be a combination of routine interest payouts and Daily Rate Rewards. The available Rate Tiers as of the date of this Terms are

2.00% per annum,

2.50% per annum and

3.00% per annum. We reserve the right to modify the terms of the Rate Tiers, at any time, based on factors including but not limited to macroeconomic changes to the Fed Funds Effective rate.

At the end of each day the rate for your Beam Account, as reflected in our records, will be used to determine your daily earnings payout. Beam will take the stated rate for your Beam Account at the end of the day and determine the daily earnings payout for a particular day assuming compounding over 365 days and the beginning balance for that day. Fractions of a penny will be rounded down and those fractions of a penny will be carried forward to the next day for purposes of determining the next day’s payout. Beam will credit both the interest and the Daily Rate Rewards you earn each day to your Beam Account by the end of the next calendar day, and all principal and interest on your balances will be available for withdrawal pursuant to the available-for-withdrawal balance as disclosed in the App.

The principal and accrued interest on your balances will be FDIC-insured up to $500,000. Daily Rate Rewards are only covered by FDIC insurance until they are aggregated with your principal balance of your Beam Account at the end of each calendar month. If you have funds at a Participating Bank outside of your Beam Account, this may impact the availability of FDIC insurance at such institution. For example, if your deposits in a Participating Bank exceed $250,000, the excess funds are not covered by the FDIC deposit insurance. You are advised to monitor your deposits in Participating Banks outside of the Program and review the list of Participating Banks carefully, which may change from time to time. You may contact Beam directly to obtain the most recent list.

A comprehensive list of Participating Banks into which your funds may be deposited is available at

www.meetbeam.com/banks. The Participating Bank list is subject to change. Interest begins to accrue when the funds are settled. Funds are "settled" when actually received by the Participating Banks. In the extremely rare event of a failure of a Participating Bank, there may be a period during which you may not be able to access your money; nevertheless, your funds will be FDIC-insured to the full amount.

1.2. Beam Account

Obtaining Balance Information. You may obtain information about the balance of funds in your Beam Account at any time by logging into the App.

Maximum Deposit. We may limit the amount you may deposit to your Beam Account. Any such limit will be disclosed in the App. The Beam Account has a maximum starting deposit limit of $15,000 per account, which may be increased in the future. The Beam Account has a weekly deposit limit of $5,000. There are no limits on withdrawals.

Fees. We do not charge any fees for the Beam account.

1.3. FDIC Insurance

The funds in your Beam Account is transmitted to the Participating Banks where the funds earn interest as described above and are eligible for FDIC insurance. Beam uses more than one Participating Bank to ensure FDIC coverage of up to

$500,000 for your cash deposits (up to $250,000 at each Participating Bank). For more information on FDIC insurance coverage, please visit

www.FDIC.gov.

2. TERMS OF SERVICES

2.1. Eligibility

To use the Services, you must be at least 18 years of age and be a U.S. citizen (or a legal U.S. resident).

2.2. Verification of Your Identity

For our compliance purposes and to provide you the Services, you hereby authorize us to, directly or through a third-party, obtain, verify, and record information and documentation to verify your identity and bank account information. When you register for the Services and from time to time thereafter, we may require you to provide and/or confirm information and documentation that will allow us to identify you, such as, a copy of your government-issued photo ID, such as a passport or driver's license.

By using the Services, you authorize us to obtain, directly or through our third-party service providers, information about you and your external bank account from the financial institution holding your external bank account and other third-party websites and databases as necessary to provide the Services to you. You agree that other third parties will be entitled to rely on the foregoing authorization granted by you. You understand and agree that the Services are not endorsed or sponsored by any third-party account providers accessible through the Services. We make no effort to review information obtained from the financial institution holding your external bank account and other third-party websites and databases for any purpose. The information you provide us is subject to our Privacy Policy.

2.3. Linking an External Bank Account

To use the Services, you will need to link at least one external bank account (“

External Account”) to your profile to earn a Beam reward. You represent and warrant that you have the right to control any External Account you sign into via the Services.

When you use the “Add Account” feature of the Service, you will be connected to the website for the third-party financial institution you have identified (or its authorized third party). You will be instructed to submit information including usernames and passwords that you provide to log you into such third-party website(s). As part of the Services, Beam will retrieve balance and other information from the External Accounts you link to your Beam Account. You authorize Beam to access your account information maintained by identified third parties, on your behalf as your agent. Beam makes no effort to review the account information for accuracy or any other purpose and is not responsible for the accuracy of such information. Beam is not responsible for the products and services offered by or on third-party sites. The Platform is not sponsored or endorsed by any third party financial institution at which you have an External Account.

If during the course of linking your External Account your profile is flagged for review by our compliance systems, you may be asked to upload documentation supporting your identity. You agree only to upload documentation that is current, accurate, and belongs to you. Deposits into your Beam Account typically take 2-3 business days to process. During that time the funds will be unavailable for withdrawal or other use.

2.4. Transferring Funds

To Your Beam Account. You may transfer funds from your External Account to your Beam Account via ACH using the Services. Only funds from your External Account may be transferred to your Beam Account. The funds in your Beam Account are held at an FDIC-insured bank in an account in your name. We are not responsible for any third-party fees that you may incur as a result of using the Services, including, but not limited to, third-party fees incurred as a result of maintaining insufficient funds in your External Account.

From Your Beam Account. You may transfer any or all of your funds from your Beam Account to your External Account using the Services. We will generally complete the requested transfer from your Beam Account to your External Account typically within 2-3 business days from our receipt of your request. It may take longer if, for example, you recently made a deposit or if you are withdrawing to a different External Account than the one used for your initial deposit. You authorize us to transfer funds from your Beam Account to your External Account without notice to you upon the closure of your Beam Account as described below and at any time if required by applicable law or if we, in our sole discretion, suspect the Services are being used for unlawful purposes or otherwise in violation of these Terms.

2.5. ACH Processor Terms of Service

We have partnered with Dwolla to provide electronic bank transfers (i.e. ACH Bank Transfers). In order to use the Services, you must open an “Access API” account provided by Dwolla and you must accept the Dwolla

Terms of Service and

Privacy Policy. Any funds held in the Dwolla account are held by Dwolla’s financial institution partners as set out in the Dwolla

Terms of Service. You authorize us to share your identity and account data with Dwolla for the purposes of opening and supporting your Dwolla account, and you are responsible for the accuracy and completeness of that data. You understand that you will access and manage your Dwolla account through the Platform, and Dwolla account notifications will be sent by Beam and not Dwolla. We will provide customer support for your Dwolla account activity, and can be reached at

[email protected].

2.6. Beam's App and Updates

From time to time, Beam may automatically check the version of App installed on your device and, if applicable, provide updates for the App. Updates may contain, without limitation, bug fixes, patches, enhanced functionality, plug-ins and new versions of the App. By installing the App, you authorize the automatic download and installation of updates and agree to download and install updates manually, if necessary. Your use of the App and updates will be governed by these Terms (as amended by any terms and conditions that may be provided with updates). Beam reserves the right to temporarily disable or permanently discontinue any and all functionality of the App at any time without notice and with no liability to you.

TLDR- high interest savings account. Base rate starts at 2%, click on the piggie daily to get daily interest rate "boost" for the day. Refer people to increase your base interest rate. It's a startup that completed Beta already. I'm trying it out with 100$

My referral here, we both get 5 boosts:

https://meetbeam.com/?r=CASH-BJ-KoanhKz

https://meetbeam.com/?r=CASH-BJ-KoanhKz (she’s not from the US) my dad just handles everything

(she’s not from the US) my dad just handles everything