- Mar 29, 2020

- 2,980

- 5,065

Lets bump this up. This thread is too good!

How many banks do you guys bank with?

One primary personal checking and a secondary personal checking for contingency needs if ever needed. Both have worldwide ATM fee reimbursement.

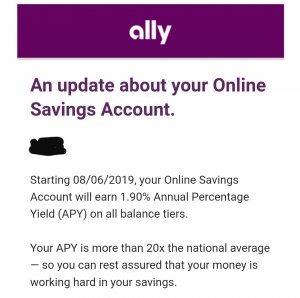

A savings account for a true emergency fund.

And a business checking account.

Some of my friends back from HS consider putting $ in a savings account as “investing” which is crazy. I think you’d def drop some emergency savings in an account first though, for sure.

Some of my friends back from HS consider putting $ in a savings account as “investing” which is crazy. I think you’d def drop some emergency savings in an account first though, for sure.