- 548

- 494

- Joined

- Jul 28, 2016

I believe my bank charges for a charge back in most cases but I could be wrong

I see on GOAT that there seems to be pairs labeled as missing laces so I would hope that the pair I bought has all accessories.

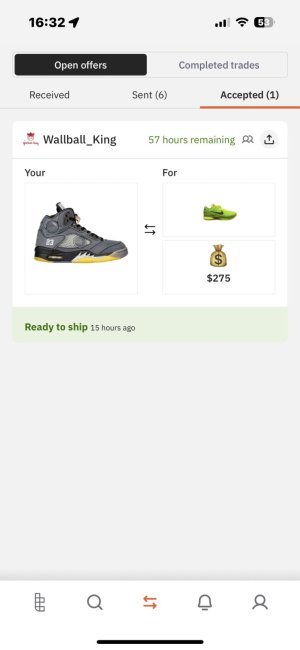

I may end up selling my pair to recoup the money as buying them was sort of an accident and they’d have to really blow me away not to try to get most of my money back

I see on GOAT that there seems to be pairs labeled as missing laces so I would hope that the pair I bought has all accessories.

I may end up selling my pair to recoup the money as buying them was sort of an accident and they’d have to really blow me away not to try to get most of my money back