EddieDoyers

formerly eddiengambino

- Apr 3, 2012

- 46,208

- 23,878

https://www.yahoo.com/finance/news/middle-class-trump-plan-mean-tax-increase-153628510--finance.html

For some in middle class, Trump plan would mean tax increase

For some in middle class, Trump plan would mean tax increase

Associated Press

CHRISTOPHER S. RUGABER 5 hours ago

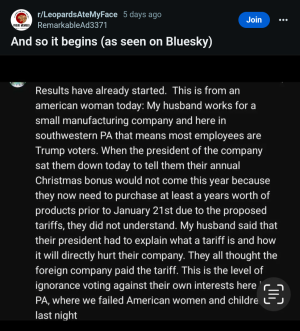

WASHINGTON (AP) — President-elect Donald Trump's proposals would modestly cut income taxes for most middle-class Americans. But for nearly 8 million families — including a majority of single-parent households — the opposite would occur: They'd pay more.

Most married couples with three or more children would also pay higher taxes, an analysis by the nonpartisan Tax Policy Center found. And while middle-class families as a whole would receive tax cuts of about 2 percent, they'd be dwarfed by the windfalls averaging 13.5 percent for America's richest 1 percent.

Trump's campaign rhetoric had promoted the benefits of his proposals for middle-income Americans.

"The largest tax reductions are for the middle class," said Trump's "Contract With the American Voter," released last month.

The tax hikes that would hit single parents and large families would result from Trump's plan to eliminate the personal exemption and the head-of-household filing status. These features of the tax code have enabled many Americans to reduce their taxable income.

His other proposed tax changes would benefit middle- and lower-income Americans. But they wouldn't be enough to offset those modifications.

"If you're a low- or moderate-income single parent, you're going to get hurt," said Bob Williams, a fellow at the Tax Policy Center.

Unlike Trump's polarizing proposals on immigration and trade, his tax plan is in line with traditional Republican policy. His steep tax cuts in many ways resemble those carried out by Presidents Ronald Reagan and George W. Bush, and the Republican-run Congress is expected to welcome them.

During the campaign, Trump said his tax cuts — for individuals and companies — would energize the economy by boosting business investment in factories and equipment, while leaving consumers with more cash to spend. His proposals, he contended, would help create 25 million jobs over the next decade.

But Lily Batchelder, a visiting fellow at the Tax Policy Center and former deputy director of President Barack Obama's National Economic Council, estimates that roughly 7.9 million families with children would pay higher taxes under his proposals. About 5.8 million are led by single parents. An additional 2.1 million are married couples.

Other analysts, including economists at the conservative Tax Foundation and right-of-center American Enterprise Institute, have agreed with Batchelder's conclusions.

Here's what her analysis finds:

Right now, a single parent with $75,000 in income and two children can claim a head of household deduction of $9,300, plus three personal exemptions. Those steps would reduce the household's taxable income by $21,450, to $53,550.

Trump's plan would more than double the standard deduction to $15,000. But that change would be outweighed by his elimination of personal exemptions and head-of-household status. So the family's taxable income would be $60,000, and their tax bill would be $2,440 more than it is now.

A married couple with four children and income of $50,000 would absorb a tax increase of $1,090 because of their loss of personal exemptions.

Kelly Rodriguez, 47, who lives in Tampa, Florida, voted for Trump and is a single mother who claims two of her four children as dependents. (Her ex-husband claims the other two.) She made roughly $90,000 last year, including alimony payments. Her taxes would likely rise under Trump's plan, according to Batchelder's analysis.

"I would want him to explain that to me," she said. "Taxes have to make sense to the people paying them."

Still, Trump's plan will likely evolve during congressional negotiations before it becomes law.

"This is not anywhere close to a final plan," Williams said.

Kyle Pomerlau, director of federal projects at the conservative Tax Foundation, noted that House Speaker Paul Ryan's own tax-cut proposal is similar to Trump's but wouldn't raise taxes on single-parent families. In theory, the two plans could be melded, and Trump's elimination of the head of household status could be dropped.

But leaving the head of household filing status and personal exemptions intact would lower tax revenue by $2.1 trillion over the next decade, the Tax Policy Center says.

Trump's advisers deny that he will raise taxes on middle-income Americans but don't provide details. Previously, the campaign suggested that Trump would broadly instruct Congress to avoid raising taxes on lower- and middle-income workers.

"We will cut taxes massively for the middle class and working class and protect everyone in the middle class and working class," Stephen Miller, Trump's top policy adviser, said in an email.

Yet all independent analyses show most of the benefit flowing to the wealthiest Americans. Nearly half of Trump's tax cuts would go to the top 1 percent of earners, the Tax Policy Center found. Less than a quarter of the cuts would benefit the bottom 80 percent.

Trump proposes to reduce the number of tax brackets from seven to three, with rates of 12 percent, 25 percent and 33 percent. That would slash the top rate from the current 39.6 percent. He would repeal the estate tax, which affects only about 0.2 percent of estates — those worth above $5.45 million.

For middle-income earners as a whole, the Trump proposals would cut taxes, even taking into account the increases on single-parent families. Those earning nearly $50,000 to about $83,000 — the middle one-fifth — would receive an average cut of $1,010, according to the Tax Policy Center. That would lift their after-tax incomes 1.8 percent.

By contrast, the wealthiest 1 percent — those earning over $700,000 — would enjoy a tax cut averaging nearly $215,000, boosting their after-tax incomes 13.5 percent. And the richest 0.1 percent — those making above $3.7 million — would receive a bonanza: An average tax cut exceeding $1 million.

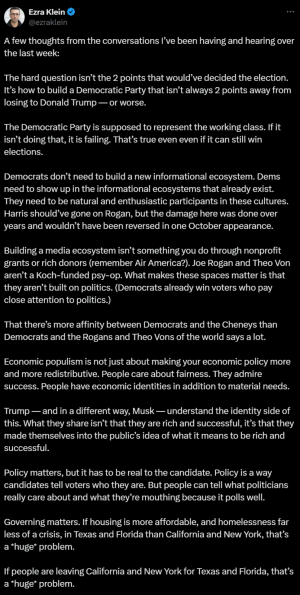

"Trump's campaign rhetoric may have been populist, but his tax plan isn't," Howard Gleckman, a senior fellow at the policy center, wrote on its website.

His tax proposals suggest what may be a challenge for Trump's administration: Providing his middle- and working-class supporters with tangible signs of economic progress. Middle-income Americans already pay a relatively modest share of federal income taxes compared with the wealthy. That limits the scope of what tax cuts could do for them.

"The thing that he needs to worry about is making life better for his supporters, and that involves more than tax cuts," Williams said.

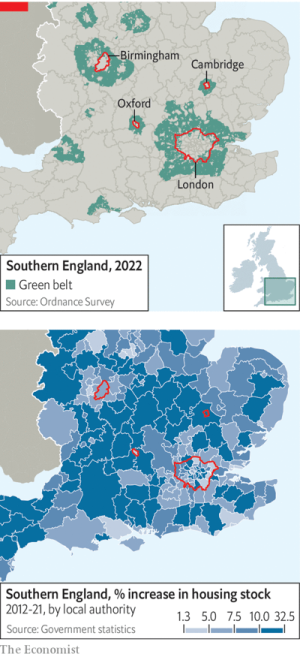

Middle class finances have also been squeezed by high and rising costs for health care, higher education and housing, noted Joseph Cohen, a sociologist at Queens College in New York City.

"We've been cutting taxes since Reagan, and things have been getting worse for the middle class since Reagan," he said.

Last edited: