- 3,411

- 6,746

- Joined

- Sep 5, 2000

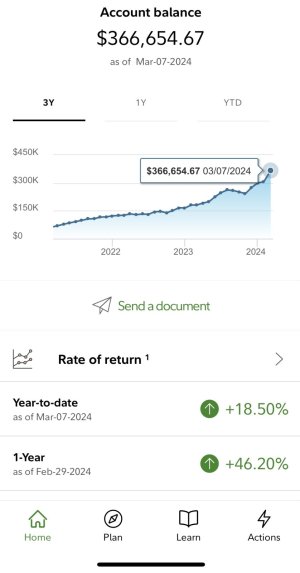

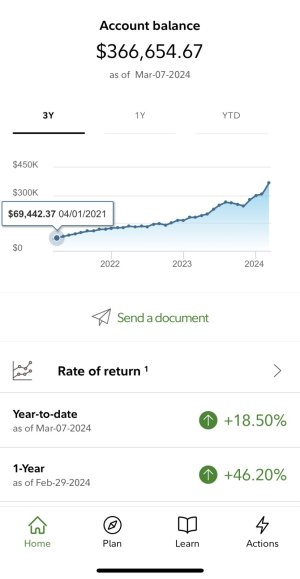

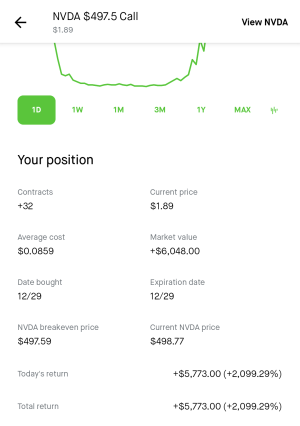

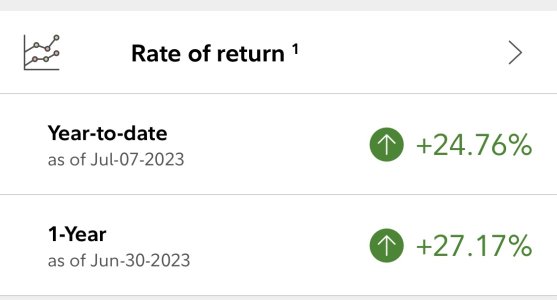

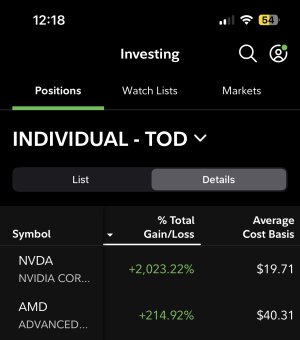

I understand that but timing a peak is too hard. I have enough left that if it goes wild like GME did I will still be loaded. However if it falls flat on it's face I still made 4 months worth of paychecks as a public school teacher.

Either way I don't have to work this summer and now I can relax before the fall semester starts. Win/win in my book.

Hey, if you’re a teacher, then let me say “Thank you!”. Not sure how it is in your part of the world, but around my way, teachers have had it tough this pandemic. I have 3 cousins who are teachers and I feel awful for what they’ve been through. The government has pretty much given them the middle finger. No contingency plans made for learning at home, not putting them on the priority list to receive vaccinations, and even having the audacity to tell them to drive down to the US border (2 hours away) to get the vaccine. And even when the province did shut down schools for 2 weeks, the teachers and schools weren’t even made aware of the decision until it was announced to the public, leaving teachers 1 day to scramble and devise home learning plans. Brutal. It has been terrifying.