[h1]OFFICIAL NT STOCK GAME VOL. 2 (SUMMER 17)[/h1][h2]

LINK TO GAME HERE[/h2]

After the successful first NT Stock Game, we are back for Volume 2. This game will be shorter-term (3 months) with a lower starting balance of $50k. Volume 2 hopes to simulate more real world portfolios.

Because of the incoming summer, the game's start date will be June 26, 2017. This will also allow for more member participation.

=========================================================

REGISTRATION

**If you already have a Marketwatch account from the first game, please use that email to log into your account.**

1.) Please sign up for a new Marketwatch account on the top of the main page. Marketwatch will send an email to your email address to confirm your account.

2.) First name should be NT. Last name should be your username. Example: NT Slighted

3.) This game is private.

Password = NTYAMBS (all caps)

4.) When your account is created, open the link above, enter the password, and click blue button TRADE NOW!

RULES

- The game will run from June 26, 2017 to August 31, 2017. New participants can NOT join after the start date. Please sign up before June 26.

- All symbols can be traded.

- Short selling and margin selling are allowed.

- Starting balance is $50,000.

- Commission/fee per trade is $5. There is no limit on amount of daily trades.

- Participants will be able to view each others' portfolios.

- You can place your trades now, but they will only take effect on the June 26 start date.

- Please bookmark the link to the game for easier access.

DUMMY ACCOUNT

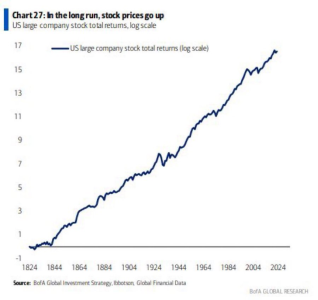

- As requested by several NT members, there will be a dummy account in this game that will

only invest in the Vanguard S&P 500 ETF (VOO). This account will be created and managed by

@Slighted

- If this account wins the game, shame on all of you deliciously debonair degenerates.

REWARDS

- The winner of this game on August 31, 2017 will receive e-kudos and a slightly used fleshlight.

.

.