- 74,762

- 24,160

- Joined

- Apr 4, 2008

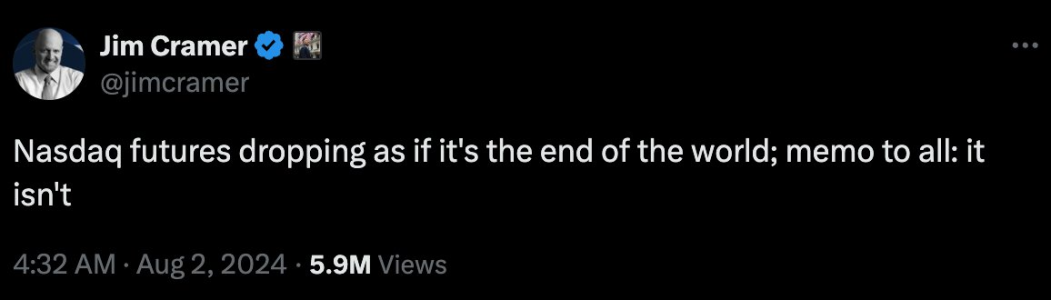

Realistically speaking, do I need to close out my savings account because of an inevitable bank run? I wanna get in front if that’s the case. Gonna need to refinance this mortgage too. If I can get a good price on 15 years. Bruh.

When it comes to negative rates, I’m gonna have to take some money out and put it into coinbase potentially and buy usdc and consider shipping some extra cash out to defi. This isn’t a good time at all for anyone but I firmly do believe if we get through covid by June we will have a rip roaring economy in the distant future.

When it comes to negative rates, I’m gonna have to take some money out and put it into coinbase potentially and buy usdc and consider shipping some extra cash out to defi. This isn’t a good time at all for anyone but I firmly do believe if we get through covid by June we will have a rip roaring economy in the distant future.