- 74,529

- 23,964

- Joined

- Apr 4, 2008

talk to an accountant b. i think you need to wait 90 days but i dont know. that's why we have accountants.

So let me get this straight, if I took $1.00 (hypothetical) hit on AAPL in the last day, I can sell that **** right now, buy back in right after, and assuming I hold through 2015, I can take the $1.00 write off on my 2015 taxes?

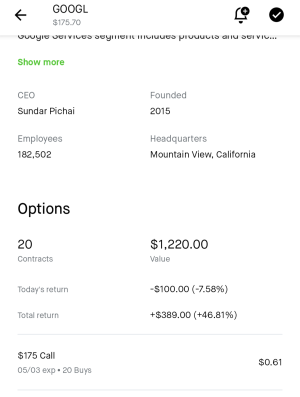

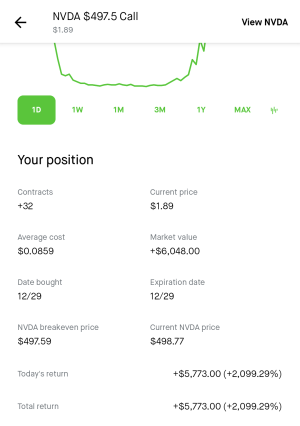

But what about this??? Lol c'mon experts!

I was under the impression you couldn't buy right back in and take the loss (up to $3k) on your taxes. I thought you had to wait like 90 days to buy back in if you're going to take the loss on W-2.

i really like the long term prospects of this one. that powerwall has so much potential.

i really like the long term prospects of this one. that powerwall has so much potential.