- 28,564

- 17,055

- Joined

- Mar 22, 2003

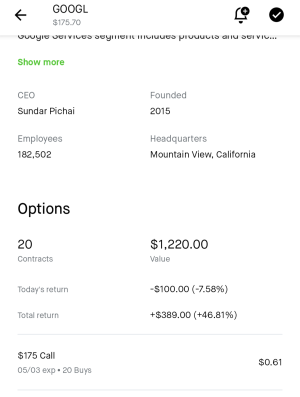

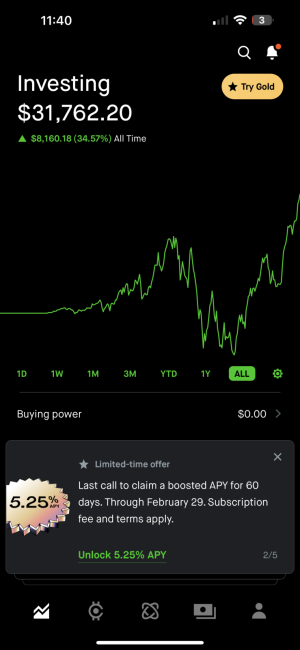

Ive noticed youve unquestionably lost large amounts of money as well. Like buying up six figures of AMC at damm near 20 bucks

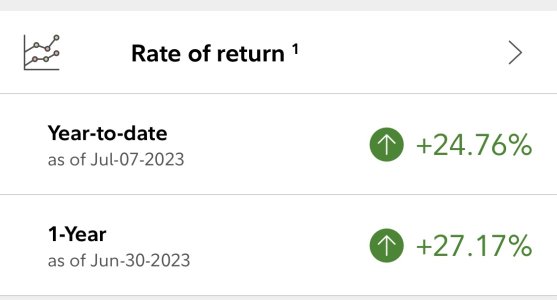

What are your total gains/losses on the year?

This is completely wrong - the most I spent on AMC was 15.80 and that moved my position from the 5’s to the 6’s.

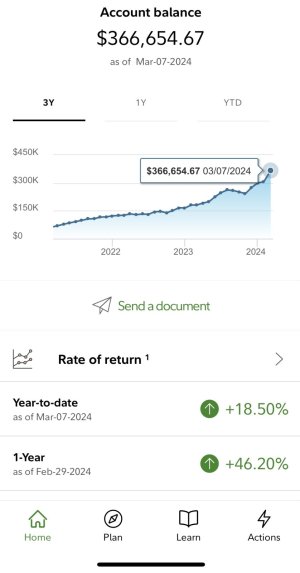

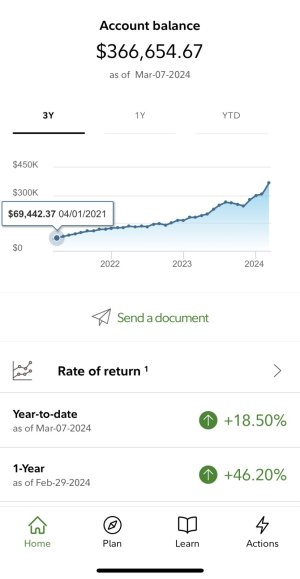

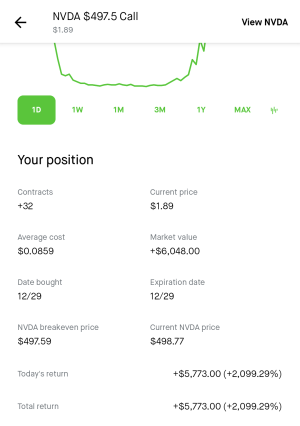

The T12 I’m +628k

Last edited:

.

. .

.