- 74,930

- 24,346

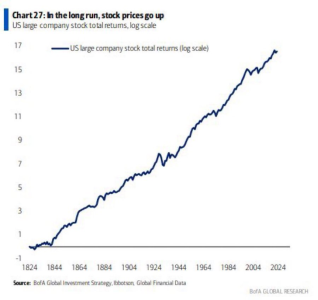

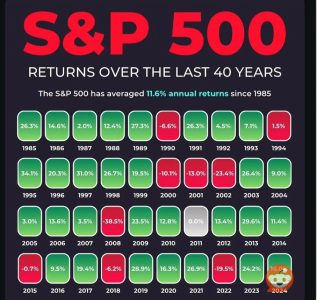

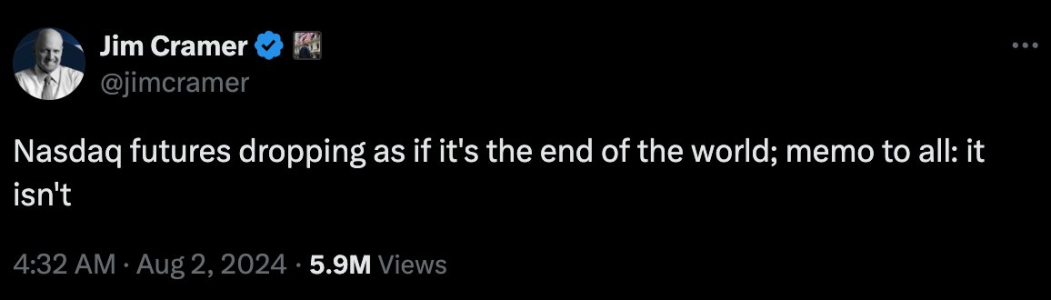

Because treasury yields are returning to pre Covid levels, temporary inflation as a result of the economy reopening, and the S&P having a higher P/E ratio that usually leads to a top.Why is everyone saying the market is going to crash in 2021

it’s all ******** because yields can go to 3% and it won’t negatively affect anyone in reality. The inflation fears are bs since were in a deflationary environment thanks to innovation and tech, reflation will go away after The world is temporary,to the s&p can grow into its ratio with strong earnings, and the fed is incredibly accommodative and not tightening. It’s all stupid noise. If you’re u comfortable, take some money off, but overall I’m using the volatility to buy more when I can.