- 21,223

- 11,819

- Joined

- Oct 10, 2005

Someone convince me that NVDA is not a pandemic stock.

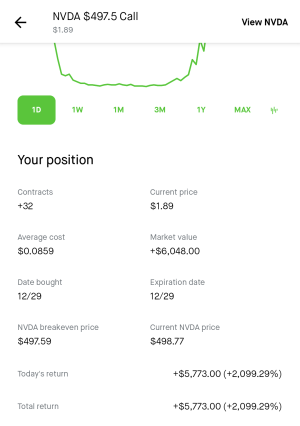

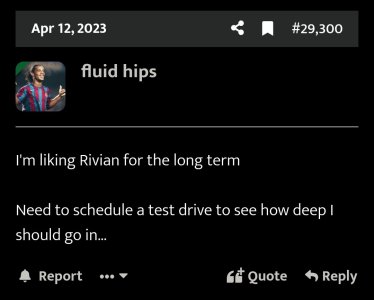

This was a year ago… come on, man

.

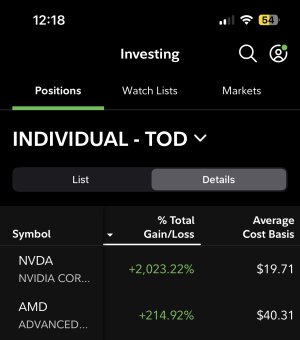

.Someone school me on NVDA. Is this really a $500 stock?

Yes, they have the best GPUs right now and are making all the right moves. Likejohnnyredstorm mentioned, they’re in the autonomous driving sector and have partnerships with Audi (Volkswagen), Mercedes, Toyota, Volvo, and BMW. They’re also in the AI sector and using it to help USPS with their efficiency issues and using it to help cities become more efficient with things ranging from disaster response to traffic. They bought Mellanox to boost their data centers. Still big in the gaming sector (were used in Nintendo Switch). For whatever reason, AMD is the “darling” of the sector, but they can’t hold a candle to what NVDA is doing. And Intel is falling off hard right now.