- 10,915

- 2,735

AT&T with the power move  RIP Gogo. Barely even knew ye. Wonder how they would be able to keep a consistent connection especially in rural areas though.

RIP Gogo. Barely even knew ye. Wonder how they would be able to keep a consistent connection especially in rural areas though.

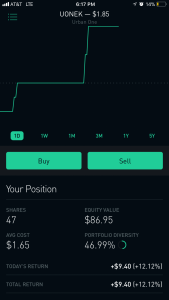

Nice trade JRS. I took a small loss trying to scalp solars. Meh.

RIP Gogo. Barely even knew ye. Wonder how they would be able to keep a consistent connection especially in rural areas though.

RIP Gogo. Barely even knew ye. Wonder how they would be able to keep a consistent connection especially in rural areas though.Nice trade JRS. I took a small loss trying to scalp solars. Meh.

Last edited: