rhythm808

Banned

- 1,221

- 164

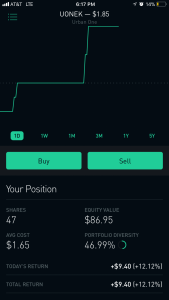

Agree with you I am actually in NURO though...looking for an earnings beat this Thursday pre-market.Wanted to pick up a call for ICPT the last two sessions but got scared [emoji]128557[/emoji]

Bios breaking the trend

. so it is true this months expiry is not an active one.

. so it is true this months expiry is not an active one.

. Then in the CC the CEO said they are most likely going to get approved by the Chinese and Japanese governments in order to get the product selling there. So overall it was pretty positive...gapped up 3.5% to open but then just took a hit the rest of the day.

. Then in the CC the CEO said they are most likely going to get approved by the Chinese and Japanese governments in order to get the product selling there. So overall it was pretty positive...gapped up 3.5% to open but then just took a hit the rest of the day.