- Nov 20, 2003

- 21,365

- 812

Yikes, if this is what you really think.

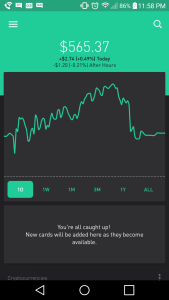

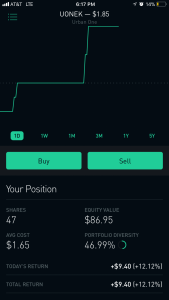

On that note: This market is scaring the ish out of me. Too much volatility with low volume. IPO bubble happening, this P2P lending bubble, this credit bubble, VIX has gone from 12 to 16 etc. We're due for a correction soon. It's going to get UGLY people.

There's too much leverage in the system right now and once rates go up, people will be caught with their pants down. This is the type of hit that happens so fast, most people don't see it coming. I've seen this movie before. Trust me, it doesn't end well.

I thought about Fed rates and all of that happening in the next year, and the crazy run we've been on, and for that reason, I'm out

/sharktank