- Mar 14, 2006

- 17,697

- 2,714

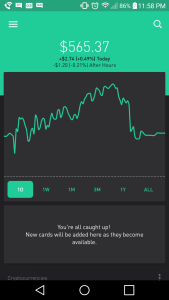

NKE jumping after that earnings report. I've been watching but didn't get in, now I have to wait for a pull back. GPRO is performing solid too, glad I got in, not for many shares tho. Slow process for me with not much capital but I'm gon get there

12% gain on the day jesus, missed that earnings play but don't think many people saw that coming.

$MU beat helped me out, probably won't cross $34 this week but will hold for now as I think the sell-off is over. could climb to new highs next week given that resistance was $33ish for the longest time.

That's the same thing I said about NKE. Seen it dancing around $77 then boom, after hours boost. A new 52wk high definitely adds promise tho

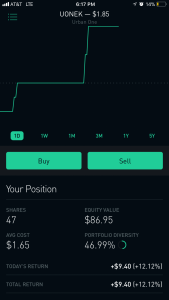

my 54-55 call spread should get max value long as it holds this bid. Sweet.

my 54-55 call spread should get max value long as it holds this bid. Sweet.